Europe Dairy Market Size

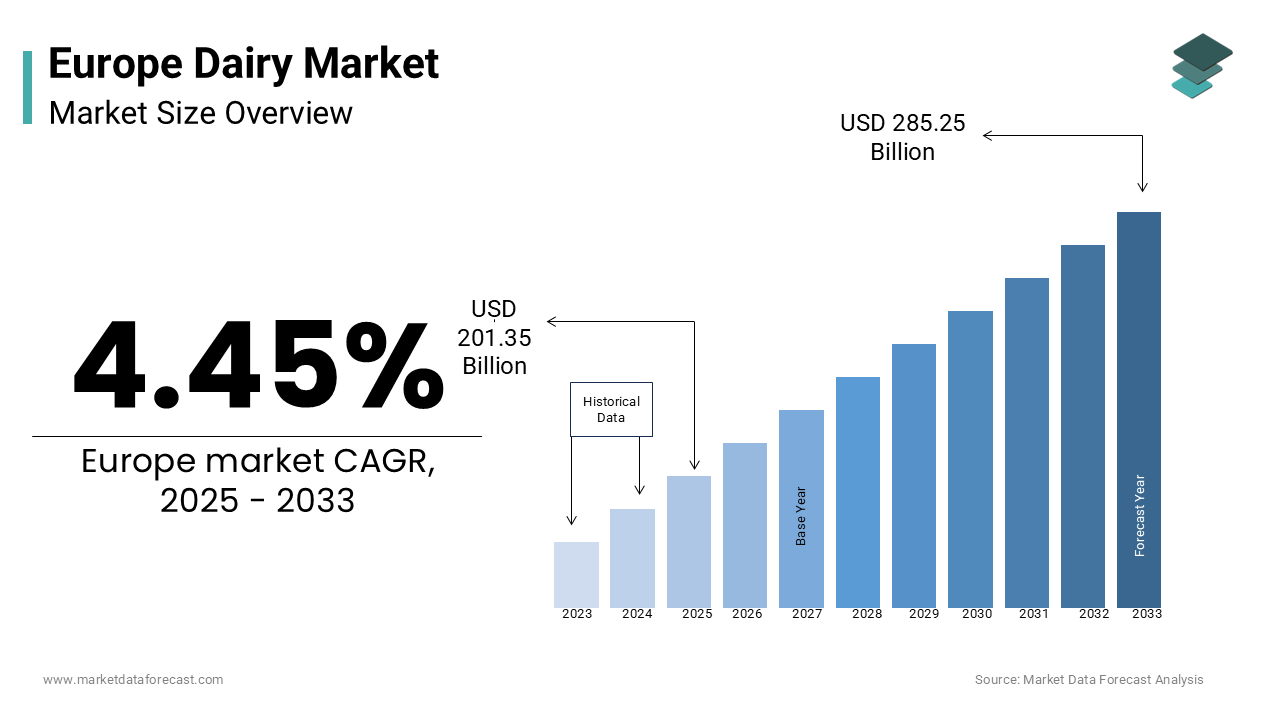

The europe dairy market was worth USD 192.7 billion in 2024. The European market is estimated to grow at a CAGR of 4.45% from 2025 to 2033 and be valued at USD 285.25 billion by the end of 2033 from USD 201.35 billion in 2025.

The high consumer demand and robust production capabilities are certainly prominent factors for the Europe dairy market growth. According to Eurostat, the EU produces approximately 170 million tons of raw milk annually is making it one of the largest dairy markets globally. Germany, France, and the Netherlands collectively account for over 50% of this production due to their pivotal roles in the market. Consumer preferences are shifting toward health-conscious choices, such as low-fat and plant-based alternatives, which are reshaping product portfolios. As per the European Food Safety Authority, organic dairy products have seen a 20% increase in demand since 2020 with growing awareness of sustainable practices. Additionally, stringent food safety regulations ensure superior quality, fostering trust among consumers.

MARKET DRIVERS

Rising Health Awareness and Nutritional Demand

Health consciousness among European consumers is a significant driver propelling the dairy market forward. According to the European Food Information Council, over 60% of consumers prioritize protein-rich diets, with dairy products like yogurt and cheese being primary sources. In 2022, the European Dairy Association reported a 15% surge in demand for fortified dairy products, such as vitamin D-enriched milk is aligns with public health campaigns addressing nutritional deficiencies. Furthermore, as per the World Health Organization, probiotic-rich products like yogurt have gained traction due to their gut health benefits is driving a 25% increase in yogurt consumption across urban areas. Governments, such as those in Germany and Sweden, actively promote dairy consumption through dietary guidelines, further boosting sales.

Export Growth and International Trade Agreements

Export opportunities and international trade agreements are another critical driver shaping the Europe dairy market. According to the European Commission, dairy exports to Asia and North America grew by 18% in 2022, with cheese and butter being the most sought-after products. The EU-Canada Comprehensive Economic and Trade Agreement (CETA) has particularly benefited dairy producers by reducing tariffs and increasing accessibility to foreign markets. Additionally, as per Eurostat, the Netherlands exported €10 billion worth of dairy products in 2022 with its role as a key exporter. The European Dairy Farmers’ Association notes that global demand for premium European dairy, driven by its reputation for quality, continues to rise. These factors collectively demonstrate how trade agreements and export potential are propelling the market on a global scale.

MARKET RESTRAINTS

Environmental Regulations and Sustainability Concerns

Stringent environmental regulations pose a significant restraint on the Europe dairy market. According to the European Environment Agency, methane emissions from livestock of agricultural greenhouse gas emissions is prompting stricter policies under the EU Green Deal. Compliance with these regulations often requires substantial investments in sustainable farming practices, such as manure management systems, which can cost farmers up to €50,000 annually. Additionally, as per the European Commission, subsidies for small-scale dairy farms have decreased by 10% since 2020 is exacerbating financial pressures. These challenges not only increase operational costs but also limit production capacity for smaller enterprises. The push for carbon neutrality further complicates matters, as farmers must adopt energy-efficient technologies while maintaining profitability.

Fluctuating Raw Material Costs

Fluctuating raw material costs are another major restraint affecting the Europe dairy market. According to the European Milk Board, feed prices increased by 25% in 2022 due to supply chain disruptions and geopolitical tensions. This volatility directly impacts milk production costs, with farmers facing profit margins squeezed by rising expenses. Additionally, as per Eurostat, energy costs for processing and refrigeration surged by 30%, further straining manufacturers. According to the European Federation of Food Industries, these cost fluctuations have led to price hikes for end consumers by reducing affordability in certain regions. Such economic uncertainties hinder long-term planning and investment is creating a challenging environment for sustained growth.

MARKET OPPORTUNITIES

Plant-Based and Alternative Dairy Innovations

The rise of plant-based and alternative dairy products presents a lucrative opportunity for the Europe dairy market. The increasing vegan and flexitarian lifestyles in urban areas to follow healthy lifestyle habits is gearing up for the growth of the market. Products like almond milk, oat yogurt, and soy-based cheeses are gaining popularity, with Germany and the UK leading adoption rates. The European Food Safety Authority notes that alternative dairy products now account for 10% of total dairy sales by reflecting shifting consumer preferences. These innovations not only cater to health-conscious consumers but also align with sustainability goals by offering immense growth potential.

Digitalization and E-commerce Expansion

The digitalization and e-commerce expansion are transforming the Europe dairy market by creating new avenues for growth. According to Eurostat, online grocery sales grew by 40% during the pandemic, with dairy products being a top category. Platforms like Amazon Fresh and local e-commerce players have capitalized on this trend is offering subscription models for fresh milk and yogurt delivery. According to the European Retail Institute, e-commerce accounts for 15% of total dairy sales in urban areas, with projections to reach 25% by 2025. Additionally, as per the European Dairy Association, companies investing in digital traceability systems have improved supply chain efficiency by 20%.

MARKET CHALLENGES

Declining Farm Numbers and Labor Shortages

The decline in farm numbers and labor shortages poses a significant challenge to the Europe dairy market. According to Eurostat, the number of dairy farms in the EU decreased by 20% between 2015 and 2022 due to aging farmers and limited succession plans. The European Agricultural Machinery Association notes that labor shortages have resulted in a 15% reduction in milk production in certain regions. Additionally, as per the European Parliament, wages in the agricultural sector have risen by 10% to attract skilled workers, increasing operational costs. These challenges not only threaten supply stability but also hinder technological adoption, as farms struggle to maintain workforce levels.

Price Volatility and Consumer Sensitivity

Price volatility and consumer sensitivity further complicate the Europe dairy market. According to the European Commission, retail prices for dairy products fluctuated by 15% in 2022, driven by inflation and supply chain disruptions. According to the European Consumer Organisation, such fluctuations reduce consumer confidence in price-sensitive markets like Eastern Europe. Additionally, as per the European Dairy Farmers’ Association, retailers often absorb price increases to maintain competitiveness is squeezing margins for producers.

SEGMENTAL ANALYSIS

By Category Insights

The cheese segment was the largest by capturing 35.4% of the Europe dairy market share in 2024 owing to the diverse culinary applications and cultural significance in countries like France and Italy. According to Eurostat, per capita cheese consumption exceeds 20 kg annually, with mozzarella and cheddar being the most consumed varieties.

The yogurt segment is estimated to hit a fastest CAGR of 7.5% during the forecast period. Its growth is fueled by health trends, with probiotic-rich products gaining traction among consumers. According to the International Dairy Federation, yogurt sales increased by 25% in urban areas, where convenience and nutrition are prioritized. Additionally, innovations in plant-based yogurt alternatives have attracted vegan and lactose-intolerant demographics is further accelerating growth.

By Distribution Channel Insights

The off-trade segment held the dominant share of the Europe dairy market in 2024. Supermarkets and hypermarkets remain the preferred choice for purchasing dairy products due to convenience and variety. The European Retail Institute notes that off-trade sales grew by 10% in 2022, driven by bulk buying and loyalty programs. Additionally, private-label dairy products offered by retailers have increased affordability by attracting budget-conscious consumers.

The on-trade segment is likely to gain huge traction with an estimated CAGR of 9.2% during the forecast period. Its growth is fueled by the resurgence of restaurants and cafes post-pandemic, with dairy products like cream and butter being essential ingredients. Additionally, specialty coffee shops offering artisanal dairy items have contributed to increased demand.

REGIONAL ANALYSIS

Germany was the largest contributor in the Europe dairy market with 26.5% of the share in 2024 with advanced production technologies and strong export capabilities. According to the Federal Ministry of Food and Agriculture, Germany produces approximately 33 million tons of milk annually by making it the largest producer in Europe. The country’s dairy sector benefits from robust infrastructure and adherence to stringent EU quality standards by ensuring premium product offerings. Notable developments include the rise of organic dairy farms, which grew by 20% in 2022, as per Eurostat. Additionally, German dairy companies are investing heavily in sustainability initiatives, such as carbon-neutral milk production is aligning with national climate goals.

France dairy market is likely to register 12.5% of CAGR during the forecast period. As per the French Dairy Board, the country accounts for 40% of Europe’s cheese exports, with iconic varieties like Brie and Camembert driving demand. In 2022, France launched a €500 million initiative to modernize dairy farms by focusing on energy-efficient practices. Additionally, the growing popularity of artisanal and organic dairy products has fueled domestic consumption among health-conscious consumers.

The Netherlands is a key player in the Europe dairy market, known for its high-quality milk and cheese exports. According to the Dutch Dairy Association, the country exported €10 billion worth of dairy products in 2022, with Gouda being a top seller. The Netherlands’ strategic location and advanced logistics network enable efficient distribution across Europe. Notably, the government has implemented policies promoting sustainable farming by reducing greenhouse gas emissions by 15%, as per the European Environment Agency. Furthermore, Dutch companies are at the forefront of developing plant-based alternatives is catering to evolving consumer preferences.

Italy’s dairy market thrives on its rich culinary heritage, with Parmesan and Mozzarella leading global demand. According to the Italian Farmers’ Association, the dairy sector contributes €15 billion annually to the economy. In 2022, Italy introduced a €200 million fund to support small-scale dairy producers by preserving traditional methods while embracing modernization. Additionally, innovations in lactose-free and functional dairy products have expanded consumer reach. These efforts reinforce Italy’s reputation for quality and innovation by ensuring its prominence in the regional market.

Sweden is emerging as a dynamic player in the Europe dairy market owing to the sustainability and digitalization. According to Statistics Sweden, the country’s dairy exports grew by 10% in 2022, with plant-based alternatives accounting for 30% of sales. Swedish companies are pioneers in carbon-neutral dairy production, supported by government incentives. The European Dairy Association notes that Sweden’s adoption of digital tools for supply chain management has improved efficiency by 20%. Additionally, urban consumers’ preference for convenience and health has boosted demand for yogurt and lactose-free products. These trends position Sweden as a hub for innovation and eco-friendly practices.

The Europe dairy market is highly competitive, characterized by global leaders and regional innovators. Companies differentiate themselves through quality, branding, and sustainability. Intense rivalry exists in segments like cheese and yogurt, where innovation and health benefits dictate consumer loyalty. Strategic investments in R&D and digitalization enable firms to stay ahead of trends, while adherence to EU standards ensures compliance and trust. Collaborations with farmers and governments further enhance market stability by fostering a dynamic and evolving landscape.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Danone, Arla Foods, Lactalis, FrieslandCampina, Nestlé, Saputo, Müller Group, DMK Group, Valio, and Sodiaal are some of the key market players in the europe dairy market.

The Europe dairy market is highly competitive, characterized by global leaders and regional innovators. Companies differentiate themselves through quality, branding, and sustainability. Intense rivalry exists in segments like cheese and yogurt, where innovation and health benefits dictate consumer loyalty. Strategic investments in R&D and digitalization enable firms to stay ahead of trends, while adherence to EU standards ensures compliance and trust. Collaborations with farmers and governments further enhance market stability by fostering a dynamic and evolving landscape.

Top Players in the Europe Dairy Market

Lactalis stands as a global leader in the market and is renowned for its diverse portfolio spanning cheese, milk, and yogurt. The company’s strength lies in its ability to cater to both traditional and modern consumer preferences, offering premium and plant-based alternatives. Lactalis has strategically expanded its presence through acquisitions, targeting emerging markets and innovative startups. Its focus on sustainability and traceability ensures compliance with EU regulations while enhancing brand loyalty. With a strong distribution network and commitment to quality, Lactalis continues to set benchmarks in the dairy sector.

Arla Foods is a cooperative-owned dairy giant, celebrated for its high-quality milk, butter, and cheese products. The company’s cooperative model ensures farmer support and product traceability, fostering trust among consumers. Arla Foods has pioneered carbon-neutral dairy production by launching initiatives to reduce emissions by 30% by 2030. Its innovative product lines, including lactose-free and fortified dairy items, cater to health-conscious demographics.

FrieslandCampina specializes in infant nutrition and dairy-based beverages is distinguishing itself through cutting-edge R&D capabilities. The company’s strengths include its focus on functional and fortified products, meeting the needs of health-conscious consumers. FrieslandCampina has invested heavily in digital transformation is improving supply chain transparency and operational efficiency. Its commitment to sustainability is evident in initiatives like carbon-neutral farms and renewable energy adoption.

Key Strategies Used by Market Participants

Key players in the Europe dairy market employ strategies such as sustainability initiatives, product diversification, and digital transformation to strengthen their positions. Sustainability efforts, including carbon-neutral production and renewable energy adoption, align with EU Green Deal objectives, enhancing brand reputation. Companies are diversifying their portfolios to include plant-based alternatives and functional dairy products, catering to shifting consumer preferences. Digital tools, such as blockchain for traceability and AI for supply chain optimization, improve efficiency and transparency. Strategic collaborations with retailers and governments ensure access to new markets and compliance with regulations. These approaches collectively drive competitiveness and long-term growth.

RECENT MARKET DEVELOPMENTS

- In April 2024, Lactalis acquired a Dutch plant-based startup to expand its alternative dairy portfolio. This move aims to capitalize on growing vegan trends and strengthen market presence.

- In June 2023, Arla Foods launched a line of carbon-neutral dairy products by aligning with EU sustainability goals and enhancing brand reputation.

- In January 2023, FrieslandCampina invested €50 million in digital traceability systems to improve supply chain transparency and efficiency.

- In September 2022, Danone partnered with a German retailer to offer exclusive yogurt variants by targeting health-conscious consumers.

- In March 2022, Nestlé introduced a range of lactose-free dairy products in Scandinavia by addressing rising demand for digestive-friendly options.

MARKET SEGMENTATION

This research report on the europe dairy market is segmented and sub-segmented based on categories.

By Category

- Cheese

- Yogurt

- Milk

- Butter

- Cream

- Others

By Distribution Channel

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe