The decrease in milk prices in Ireland has been found to be the highest in the EU, according to a report by the European Commission.

The report states that the price of raw milk in the EU has been declining and that by June 2023, it was estimated as being 23% below the peak reached in December 2022.

The highest drop between December 2022 to June 2023 was around 40%, based on June estimates, which was recorded in Ireland and Romania.

These findings were published by the commission in the summer 2023 edition of the short-term outlook report for EU agricultural markets, which presents the latest trends and prospects for agricultural markets.

The EU report has estimated that milk production will decrease by 0.2% in 2023, the cause of which begins with the decrease in milk prices.

While EU milk production grew by 0.8% between January and April 2023, the report states that the downward pressure on milk prices will lead farmers to “reflect on these changes” and engage in “accelerated slaughterings”.

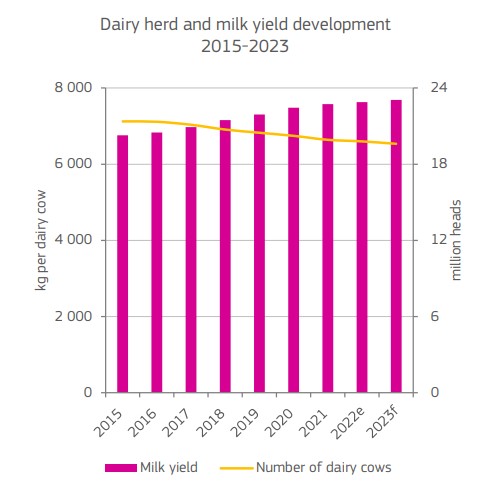

With these projected events, the EU estimates the reduction of milk production will be 0.2%, but milk yields forecasted this year will increase by 0.7%.

Until April 2023, cow slaughterings remained slightly below the level of last year, but with lower raw milk prices and high input costs, these slaughterings, according to the EU report, “will likely take place over the summer”.

EU milk trade

The report recorded that lower EU prices of some agricultural commodities have helped EU exports to grow, with exports of skimmed milk powder (SMP), whey powder, and butter increasing.

Traditional dairy products, such as cheese and fresh dairy products, have been impacted strongly by inflation, and so export volumes gains are likely to be lower.

Some input costs have continued to decline for farmers in the EU, as feed costs, after having reached a peak in quarter four (Q4) 2022, did not show an increase in Q1 2023.

Energy and fertiliser cost indices were reduced more, but compared to a higher peak than feed costs.

Despite a decline of EU raw milk prices, EU milk deliveries were 0.8% higher in January to April compared to last year.

With a smaller dairy herd, the positive spring trend of milk deliveries is likely to be reverted and so 2023 milk deliveries are projected to remain negative (-0.2%) overall.

Underpinned by lower EU raw milk prices, prices of EU dairy commodities have dropped as well.

In the case of SMP, whole milk powder (WMP), and butter, the declining trends observed in the spring showed some stabilisation, while EU prices of cheeses and whey declined further.

EU exports grew in January to March by 33% for SMP, 11% for butter and 5% for whey powders.

However, EU exports were lower for cheese (-1%) and even more for fresh dairy products (-14%) in January to March, which is reflected in a lower growth of EU exports in 2023.