- EU milk deliveries continue to increase in 2024 and are forecast to increase marginally 0.2% in 2025

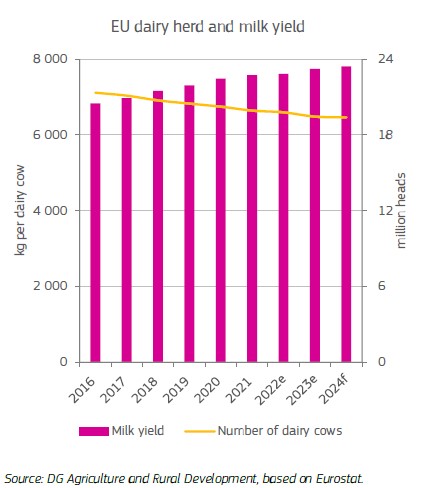

- Increasing yields to offset declining dairy herd

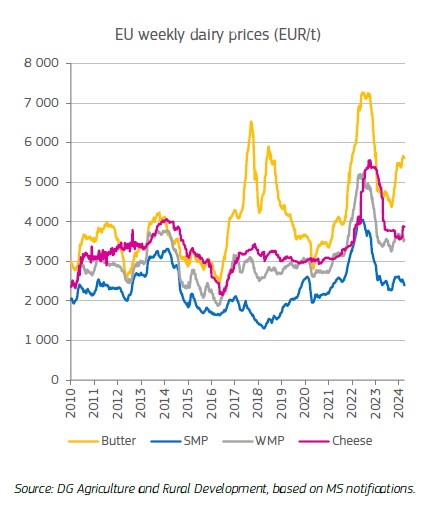

- Milk prices stabilised well above the 5-year average in 2024, easing margin pressures for farmers

- Exports are likely to remain subdued amidst weak global demand and price competitiveness challenges

Raw Milk

The European Commission expects milk deliveries in the region to increase by 0.5% in 2024 as per the latest EU short term outlook. This is slightly higher than the 0.4% increase forecast in the Spring outlook. Despite weather challenges and declining herd size, the availability and quality of grassland and fodder supported an increase in deliveries. However, varied movements were seen in production across different countries. According to the latest data available, in July deliveries picked up in France, Italy, Poland, Spain whilst it fell in Ireland and Netherlands following the impact of wet conditions. The supply of milk solids is expected to be stable.

Raw milk prices stabilised 17% higher than the 5-year average as of August 2024. Grasslands are in average condition in western Europe and weather conditions remain varied across regions. The wet spring in Ireland affected groundwork whilst hot and dry conditions in eastern and southern Europe had impact on pasture growth. On a positive note, fertiliser prices are declining compared to 2022 and energy prices have now stabilised. This could ease margin pressures for farmers.

The size of the dairy herd is predicted to continue its long-term declining trend of 0.3%. However, yields continue to increase by 0.9% in 2024, though at a slower pace compared to 2023. The decline in herd size and increase in yields appoint towards a fairly stable milk supply.

Dairy Products

Stocks of dairy products continued to tighten in Q2 2024 amidst lower imports and exports during the period. Weak global and domestic demand have affected trade flows during the period.

In 2025, the supply of milk fats is expected to be stable. This will benefit the production of cheese and whey, both predicted to increase by 0.5% and 1% respectively in 2025. SMP should also follow suit, and production is expected to increase by 1%.

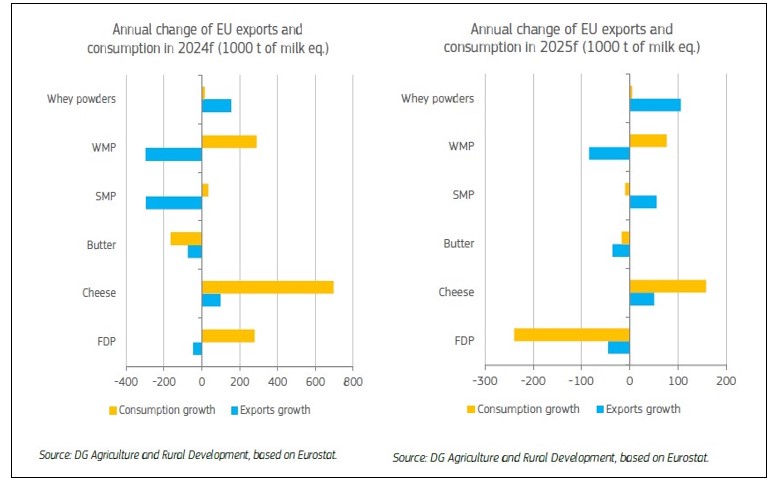

On the export front, the most likely scenario is subdued with the exception of cheese and whey. According to the EU commission, exports of cheese and whey will increase by 1% and 2% respectively. Demand resurgence is expected for high-value premium cheeses with inflation easing globally. Most of the export demand is predicted to come from UK and Switzerland.

Exports of SMP are expected to decline by 5% and that of WMP to decline significantly by 15% following inadequate demand from China and price competitiveness from New Zealand. Exports of butter and fresh dairy products follow powders and are predicted to decline by 4% and 3% respectively in 2024. Although export demand remains lower, tight stocks support firm prices. Going forward, the EU/China dispute, spread of Bluetongue, labour shortages, deforestation regulations, global economic and geopolitical tensions will be key watch points.