Researchers from Aarhus University’s MAPP Centre surveyed consumers from four European countries to gauge their perceptions of animal-free dairy – with a particular focus on precision fermentation-derived products – and determine how and why attitudes differed across different consumer groups.

Shoppers from the UK, France, Denmark and Germany were asked about their level of knowledge about the technology – which outside of food manufacture is widely used in the pharmaceutical industry – and told how it can be leveraged to create microbially-synthesized milk proteins without involving a live animal. The researchers then sought to evaluate the consumers’ perceptions on product naturalness, taste and sensory experience, sustainability, affordability, and other associations. A range of plant-based, hybrid, and precision fermentation dairy alternatives were compared, along with conventional dairy.

“We wanted to answer three questions,” said one of the authors, associate professor Marija Banovic who works at the Department of Management at the MAPP Centre. “If we have these products on the market, would they be able to stand out? So we compared them to other dairy alternatives, such as plant-based.

“The second question we wanted to address was what are the attributes that resonate with the consumer – that would ‘catch their eye’ and actually make them accept this product?

“And the final question was, if accepted, will this acceptance continue over time?”

While the paper is yet to be published in full, Banovic presented some of the key findings during January’s precision fermentation of milk proteins conference organized by the Food & Bio Cluster Denmark and held in Copenhagen.

Expanding on previous research published by herself and university professor Klaus G. Grunert on consumer attitudes on health and naturalness1 and a separate consumer study on the consumer acceptance of precision fermentation technology2, this research assesses in more depth the perceptual barriers to adopting precision fermentation-derived dairy in Europe.

While dairy alternatives that contain precision fermentation-derived milk proteins are sold in several markets – notably, the US – such food products aren’t available in Europe. This is in large part due to EU regulation that requires manufacturers to submit a Novel Food dossier to the European Food Safety Authority (EFSA) in order to obtain approval – a process that’s yet to yield a positive outcome, with the first ever application, from US-based Perfect Day, dating back to 2022.

Even though such products aren’t available to European consumers yet, the researchers argued that knowledge of early consumer perceptions could help overcome barriers to future adoption.

From ‘artificial’ to ‘innovative’

Consumers were asked about their top association when confronted with information about precision fermentation technology. The responses were mixed – Danish consumers leaned towards negative associations, with the most frequently used words being ‘artificial,’ ‘smart,’ and ‘future’. In the UK, ‘interesting’, ‘friendly’ and ‘artificial’ were the top associations; in France – ‘microbes’, ‘fermentation’ and ‘health’, and in Germany, these were ‘environmentally friendly’, ‘animal’, and ‘microbes’.

Notably, consumers strongly associated sustainability and eco-friendliness with precision fermentation, putting the technology second to plant-based alternatives in most countries.

But when it came to what’s seen as ‘healthy’, precision fermentation came last, with conventional and plant-based products perceived as the healthiest, followed by hybrid dairy.

On perceived taste and sensory appeal, precision fermentation also fared poorly, with Banovic telling the conference that manufacturers and retailers could turn to sensory marketing that emphasizes appealing flavors in order to overcome negative taste perceptions.

‘Hybrid’ potential

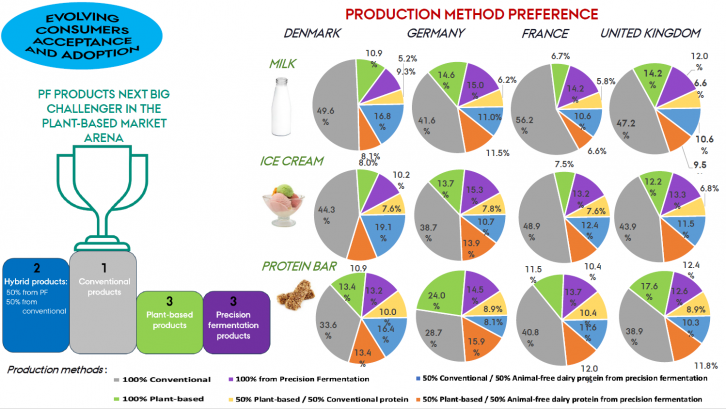

Next, the researchers asked consumers to rate nine products, including milk, ice cream, and protein bars, based on the production method involved in their manufacture. Here, precision fermentation emerged as the likely challenger of the plant-based category, while hybrid dairy – particularly products that combine traditional dairy and precision fermentation-derived ingredients – were the second most-popular among shoppers. Traditional dairy was the top choice across all nations, reflecting the category’s market dominance and provenance.

“We thought that plant-based products would be the second most-popular category,” explained Banovic. “But what came second were hybrids that combined precision fermentation and conventional dairy ingredients. And then in third place, products derived exclusively through precision fermentation had a comparable score to plant-based ones.”

The findings suggest that there could be appetite for a new dairy alternatives category that improves on the sensory and nutritional properties of plant-based alternatives. In Europe, plant-based sales decelerated in 2022, as did funding pooled by investors into the sector, but the segment continued to grow both in value and sales terms in 2022, according to data from the Good Food Institute, a think tank.

Asked if hybrid dairy – a category that’s likely more familiar to consumers in Europe – could help facilitate the acceptance of precision fermentation dairy in Europe – Banovic answered affirmatively.

“What we can see from consumer studies is that this gentle, natural transition through hybrid products can actually help much better than going straight for 100% precision fermentation-derived dairy,” she told us. “We saw that with hybrid meat products, so I think there’s scope for hybrid dairy to help in the transition.”

How did ice cream, milk and protein bars fare?

While Danish consumers had a stronger preference for hybrid products compared to precision fermentation-derived dairy, the picture was different elsewhere. German consumers picked PF-derived milk alternatives in second, as did French shoppers, while UK consumers trusted plant-based dairy alternatives. Dairy milk was everyone’s top choice, with the French expressing the strongest preference for traditional dairy.

For ice cream, Danish shoppers picked a mix of conventional and precision-fermentation derived protein products as their second most preferred option; the Germans narrowly chose a plant-based and precision fermentation hybrid in second place; the French opted for 100% precision fermentation-derived ice cream there, as did the British.

Protein bars was the category where alternative production methods came closer to catching up with traditional dairy, particularly in Germany where 24% of shoppers picked plant-based alternatives versus 28.7% who chose conventional dairy.

When all data was aggregated, the proverbial rankings were led by conventional dairy products, followed by hybrids that combined 50% precision fermentation-derived ingredients and 50% conventional, while plant-based and 100% precision-fermentation products shared the third place.

When it came to shoppers’ willingness to pay the higher price tag of animal-free dairy, the researchers found that none of the four consumer groups were willing to meet either the reference price nor an estimated price for precision fermentation products, though some (Denmark and the UK) were slightly less unwilling compared to others (France). “Overall, we found a very low purchasing willingness and high price sensitivity,” Banovic explained, adding that the researchers observed a similar trend among US consumers. “Because these products are quite high in price, we would suggest value-driven price models or a promotional discourse.”

In a separate research project Banovic’s team are currently looking into consumer pricing sensitivity, comparing the US market with Europe. Asked how consumer perceptions compared, the associate professor told us: “We just finished with the data collection on this new cross-cultural study, which comprises three EU countries and the US, where we were looking specifically into consumer willingness to pay for animal-free dairy milk. We are in the process of writing it up, so I cannot reveal much, but I can confirm that consumers are quite price-sensitive in relation to animal-free milk, and this cuts across all countries.”

Meanwhile, younger consumers, particularly Millennials, appeared more open to trying novel dairy alternatives, the researcher said. “We were looking at the age groups between 20 and 70 years old,” Banovic told us. “What we could see was that those under 35 years of age were more likely to accept and had a higher likelihood of buying products from precision fermentation technology.”

While European consumers did not appear to rate precision fermentation-derived dairy highly in terms of sensory experience and price, the technology’s perceived environmental credentials could help marketers, Banovic concluded. “We know that positive associations exist, and these are the benefits that should be highlighted,” she said. “For example, the relation to a lower carbon footprint that consumers are seeing, the environmental and animal welfare benefits, and so on.”

Sources:

1. Consumer acceptance of precision fermentation technology: A cross-cultural study

Authors: Banovic, M., Grunert, K. G.

Published: Innovative Food Science and Emerging Technologies 88 (2023) 103435

www.elsevier.com/locate/ifset

2. Beyond sugar: Exploring the influence of health and naturalness framing on attitudes towards products with sweet proteins in Europe

Authors: Banovic, M., Grunert, K. G.

Published: Food Research International 175 (2024) 113767

www.elsevier.com/locate/foodres