European dairy co-operative Arla Foods is forecasting a total revenue of nearly $25 billion this year.

The farmer-owned milk processor says that while geopolitical tensions continue, the positive trend on consumer purchasing power from the first half of 2024 should prolong into the second half, especially in Europe as inflationary pressure continues to subside and wages increase.

“This is anticipated to translate into a continued upturn in the demand for dairy, although it is uncertain how consumers will react to the expected higher retail price levels following the commodity price increases,” Arla says.

“The uncertainty is also underlined by a lesser volume of available milk on a global level.”

Arla Foods is owned by more than 8400 farmers from Denmark, Sweden, the UK, Germany, Belgium, Luxembourg and the Netherlands. The co-op is one of the leading players in the international dairy arena with well-known brands like Arla, Lurpak, Puck and Castello.

For half-year ending June 30, 2024 Arla Foods reported total revenues of almost $12 billio and achieved a net profit of $300m. For the six months, Arla collected 7 billion kg of milk.

Peder Tubough, Arla Foods chief executive says it has delivered a robust half-year performance in 2024 where the positive trajectory from the later part of 2023 has continued.

The performance allowed Arla to increase the milk price by nearly 10c/kg of milk, compared to the second half of 2023 and pay a half-year supplementary payment to farmer owners of 3.5c/kg of milk, based on the half-year volumes.

“We are satisfied that the momentum created by our farmer owners and employers in 2023 has continued into 2024, and today Arla is able to announce a robust half-year result with a competitive milk prices that paves the way for enhanced sustainability efforts going forward,” says Tubough.

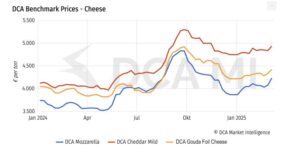

He notes that the rising milk price and the half-year supplementary payments are mainly driven by rising commodity prices, Arla’s Fund Our Future transformations & efficiency programme and a return to branded volume growth.

Arla’s strategic brands had a volume driven revenue growth of 4.1% in the first half of 2024 compared to a decrease of 6.0% in the first half of 2023.

The growth was spearheaded by the Lurpak, Puck and Arla brands which respectively grew volumes by 7.9%, 4.4% and 3.8% in the first half of 2024.

“We are very pleased to deliver a competitive milk price.

“At the same time, the return to branded growth happened with a higher magnitude than expected due to the strength of our brands and successful efforts to regain growth, so we are on a positive trajectory.”