Ireland has found itself among the European Union (EU) countries grappling with a decline in beef production during the initial five months of 2023, as highlighted in a newly released global report by Rabobank. The report underscores that reduced supply is a major factor influencing the European market, while also noting that the average beef carcass price in the EU has fallen below last year’s levels.

Rabobank’s Global Beef Quarterly report reveals a 5% year-on-year decrease in beef production across Europe during the first five months of 2023. Angus Gidley-Baird, senior analyst for animal protein at Rabobank, highlights that softer consumer demand and supply chain challenges are prevailing themes across most global markets, except for the United States.

Within Europe, Italy experienced the most significant decline in beef production, witnessing a 25% year-on-year drop from January to May 2023. Spain followed with a 7% decrease, Ireland saw a 5% reduction, while France and Poland each faced a 3% dip in production during the same period. Interestingly, the Netherlands stood out with a 3% increase in production, possibly attributed to declining profitability on Dutch farms and the uncertainty surrounding environmental permits, leading dairy farmers to maintain cattle numbers.

The Global Beef Quarterly report further highlights that EU and UK beef exports dipped by 15% year-on-year in the initial five months of 2023, whereas imports increased by 5% during the same period due to domestic supply constraints.

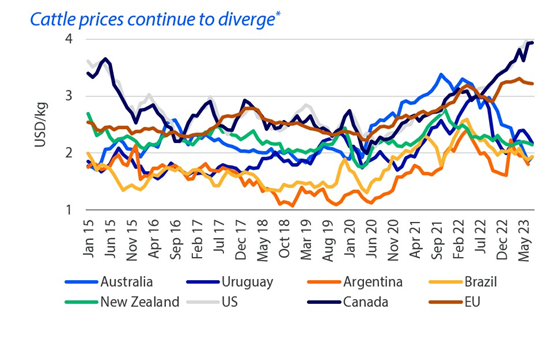

Globally, cattle prices are currently segregated into two main categories: North America and Europe on one side and the rest of the world on the other. In the US, reduced supply coupled with robust consumer demand has bolstered cattle prices. In contrast, Australian cattle prices have plummeted by over 30%.

In New Zealand, the report projects increased dairy cow culling following a significant downward revision in farmgate milk prices for the 2023 season. In Brazil, shipments to its primary export market, China, are rebounding after an earlier suspension. However, weak domestic consumption and a drop in chicken prices have hindered the recovery of live cattle prices.

The report also delves into the Chinese beef market, indicating weaker performance in 2023 with both domestically produced and imported beef prices experiencing a 23% year-on-year decline in July.

Rabobank’s report additionally highlights the growing prominence of nature and biodiversity in discussions about beef sustainability. Gidley-Baird notes that fewer companies within the beef supply chain have made voluntary commitments concerning nature and biodiversity compared to those focusing on emissions reduction.