Overview The European dairy market continues to experience a gradual decline in prices across various segments, reflecting a complex interplay of global supply and demand. While New Zealand and the U.S. have recorded growth in production, Europe’s milk supply remains relatively stable, with minor fluctuations in key dairy-producing countries.

Milk Price Trends

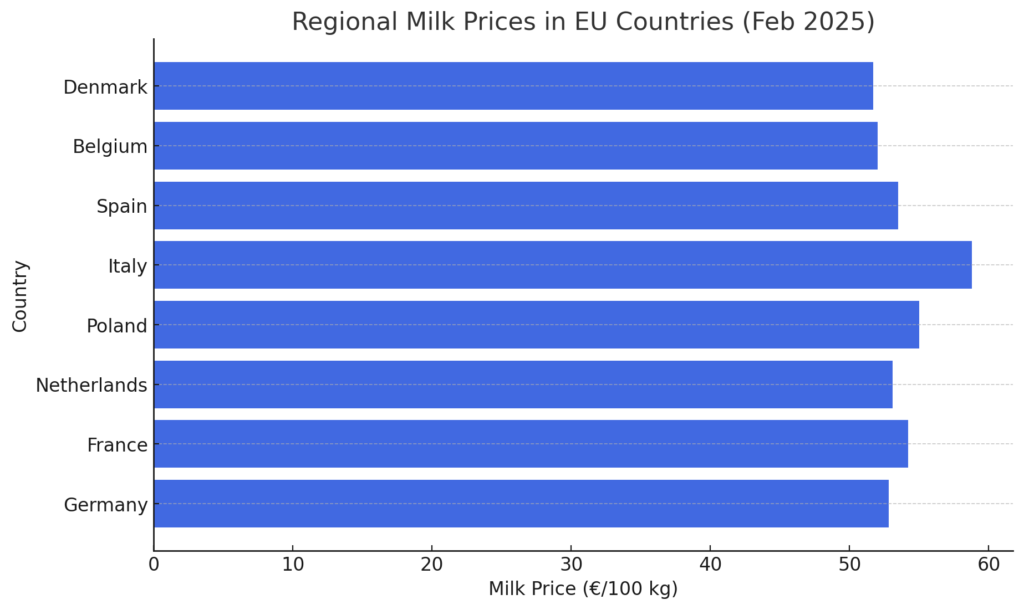

As of February 2025, the weighted EU average raw milk price stands at €54.3 per 100 kg, showing a slight drop from previous months. The highest milk price in Europe is observed in Italy (€58.8 per 100 kg), followed by Poland (€55.0 per 100 kg) and France (€54.2 per 100 kg). On the lower end, Denmark reports €51.7 per 100 kg, while Belgium and Germany remain around €52-53 per 100 kg.

As of February 2025, the weighted EU average raw milk price stands at €54.3 per 100 kg, showing a slight drop from previous months. The highest milk price in Europe is observed in Italy (€58.8 per 100 kg), followed by Poland (€55.0 per 100 kg) and France (€54.2 per 100 kg). On the lower end, Denmark reports €51.7 per 100 kg, while Belgium and Germany remain around €52-53 per 100 kg.

Dairy Commodity Prices

- Butter: €7,759/tonne (EU), down 2.5% from the previous period.

- Skimmed Milk Powder (SMP): €2,666/tonne, a 1.3% increase.

- Whole Milk Powder (WMP): €4,565/tonne, up 3.2%.

- Cheddar Cheese: €5,021/tonne, rising by 1.5%.

Globally, EU dairy prices remain higher than Oceania but are beginning to converge with U.S. rates. Oceania’s butter price sits at €6,925/tonne, whereas in the U.S., it has dropped to €5,455/tonne.

Production Insights

- European Milk Production: January-November 2024 data reveals a 0.7% year-over-year increase.

- New Zealand: Milk production has surged 3.6% (June-November 2024), sustaining its strong global export position.

- U.S. Production: Slightly declined by 0.3% (January-November 2024), mainly due to lower yields in key states.

Global Trade & Market Sentiment

The Global Dairy Trade (GDT) auction on February 4, 2025, saw a 3.7% price increase across all dairy categories. Key trends include:

- SMP price surge of 4.7% in global markets.

- WMP climbing 4.1%, indicating strong international demand.

- Butter increased by 2.4%, though European prices remain elevated compared to Oceania.

Despite these increases, trade uncertainties and fluctuating demand in China, the U.S., and the Middle East continue to add complexity to the European dairy outlook.

Conclusion

While the EU dairy sector faces a slow decline in prices, certain segments, such as WMP and SMP, are experiencing positive adjustments. The global dairy market remains dynamic, with New Zealand’s continued growth and U.S. supply constraints playing key roles in shaping international price movements.

Key Takeaways

✅ EU raw milk price: €54.3/100 kg, Italy leads at €58.8/100 kg. ✅ Butter prices falling in the EU, but SMP & WMP show resilience. ✅ New Zealand milk production surging, impacting global supply. ✅ U.S. production slightly declining, contributing to price stabilization. ✅ Global Dairy Trade shows price upticks, indicating firm demand for powders.

The coming months will be crucial in determining whether European dairy prices stabilize or continue their downward trend amid shifting global market conditions.