Key points:

-

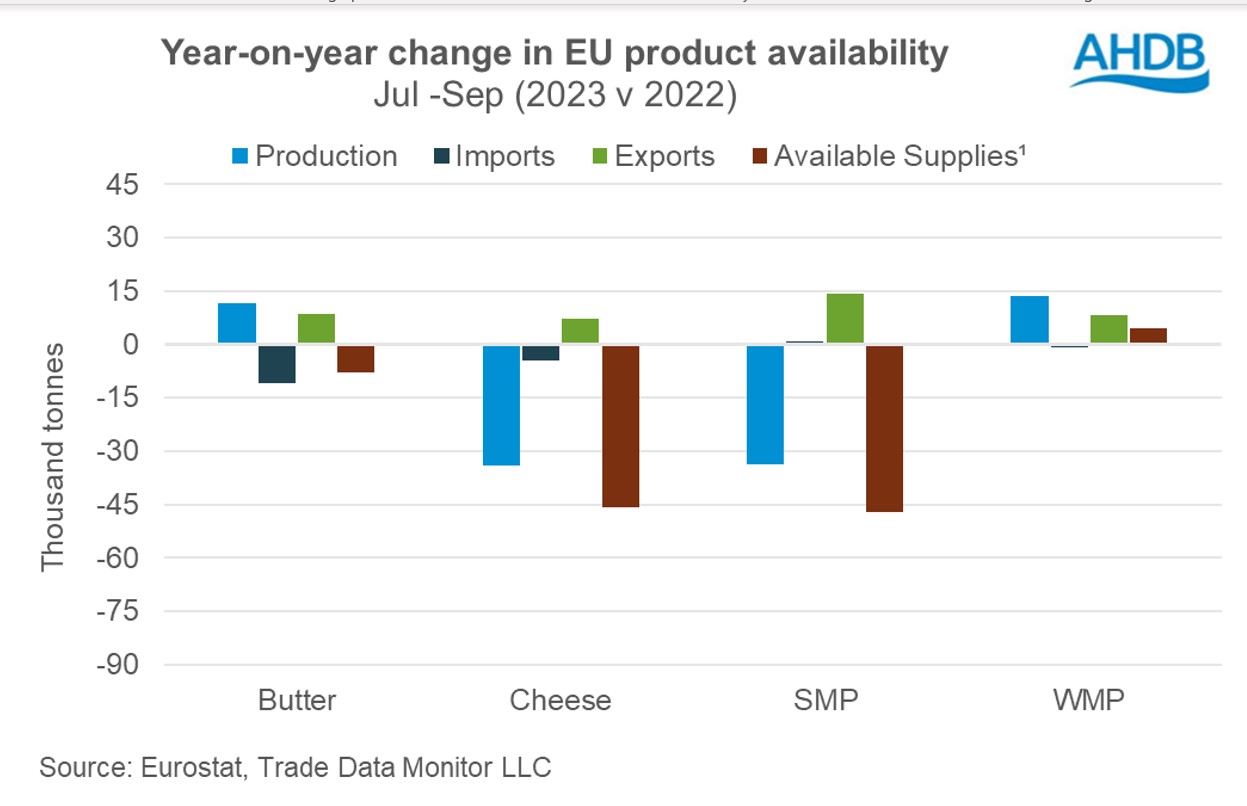

EU’s dairy product availability continue the downtrend in Q3 2023

-

Demand from MENA and South-east Asia fuelled exports

-

Sharp fall in SMP availability

-

WMP supplies was the exception, boosted by higher production

EU dairy product availability continued the downtrend in Q3 2023 with the exception of WMP where higher production improved availability. Available supplies* have been challenged by trade dynamics and supply. A marginal decline of 0.2% has been reported in milk deliveries in EU during the third quarter year on year which has contributed to lower available supplies in the market.

Demand on the continent remained subdued amidst inflationary pressures. On the global front, after having remained quiet for sometime, China seems to be returning to the market. Hopes are hanging on improved Chinese demand in the first quarter of 2024 ahead of Chinese New Year. Although exports of milk powders to China declined, butter and cheese exports increased in Q3. Apart from China, more exports also went to the Middle East and North Africa (MENA) and South-east Asia. However, with EU milk production looking to have grown in 2023, build-up of dairy product stocks will depend on of the extent of demand in the continent and overseas.

Butter stocks drop due to exports and domestic demand

The decline in available butter supplies in Q3 resulted primarily from an increase in exports although the drop in import volumes will have also added to lower supplies. Production volumes increased with more milk being available for turning into butter. Domestic demand for packaged retail butter increased as buyers returned from their summer holidays.

Cheese production declined

Cheese supplies also trended lower compared to Q3 last year. Although exports grew, production and imports were lower year-on-year. The relatively larger drop in production meant overall availability remained lower. Export demand was reported to U.A.E, Morocco, Libya, China and Canada.

SMP production fell whilst exports grew

Available supplies of SMP declined the most, dropping -25.8% year-on-year in Q3 2023. To begin with, production fell by -9.4% compared to the year before. And then lower prices made exports attractive, increasing by 7.7%. Due to this, overall availability of SMP declined during the period.

WMP supplies increase as production grows

WMP saw a year-on-year increase in availability, bolstered by higher production. Whilst imports were lower by -11.7%, exports picked up by 14.2% and production increased by 11.3% year-on-year. Though milk supplies were tightening, processors made WMP to meet export demand.

According to Rabobank, milk deliveries in EU are expected to shrink 0.5% year-on-year in Q1 2024. This would boost the market sentiment to start the year. However, demand remains instrumental for the direction of the market. On one hand inflation is easing and salaries have been increasing, but higher interest rates could undermine consumer confidence further.