- Available supplies of EU’s dairy products fall

- Lower production weakens stocks across the board

- Exports of butter and cheese in growth whilst that of milk powders decline

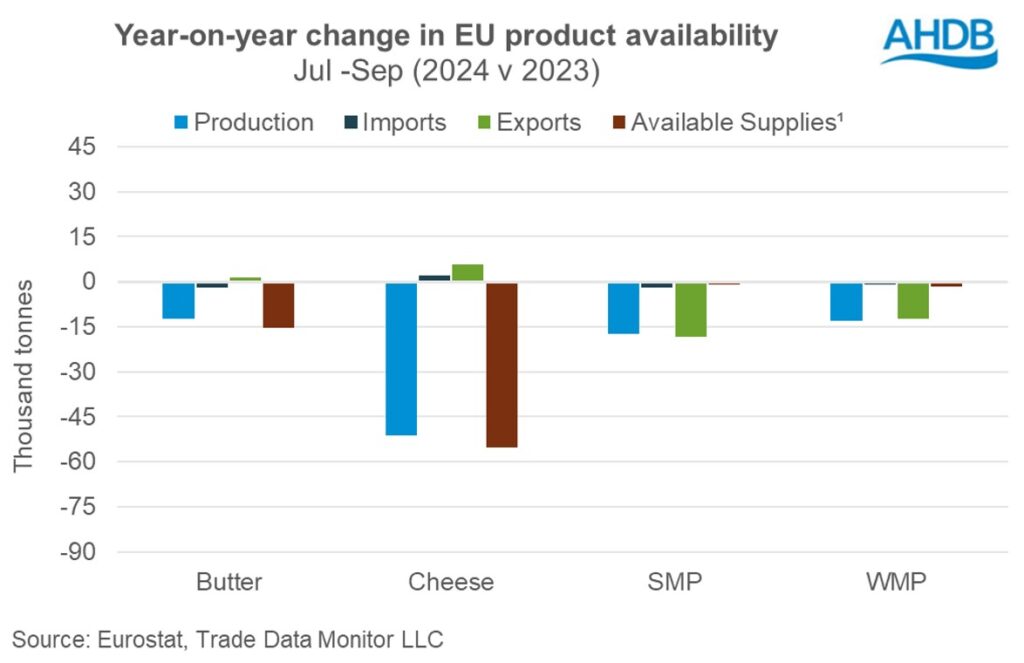

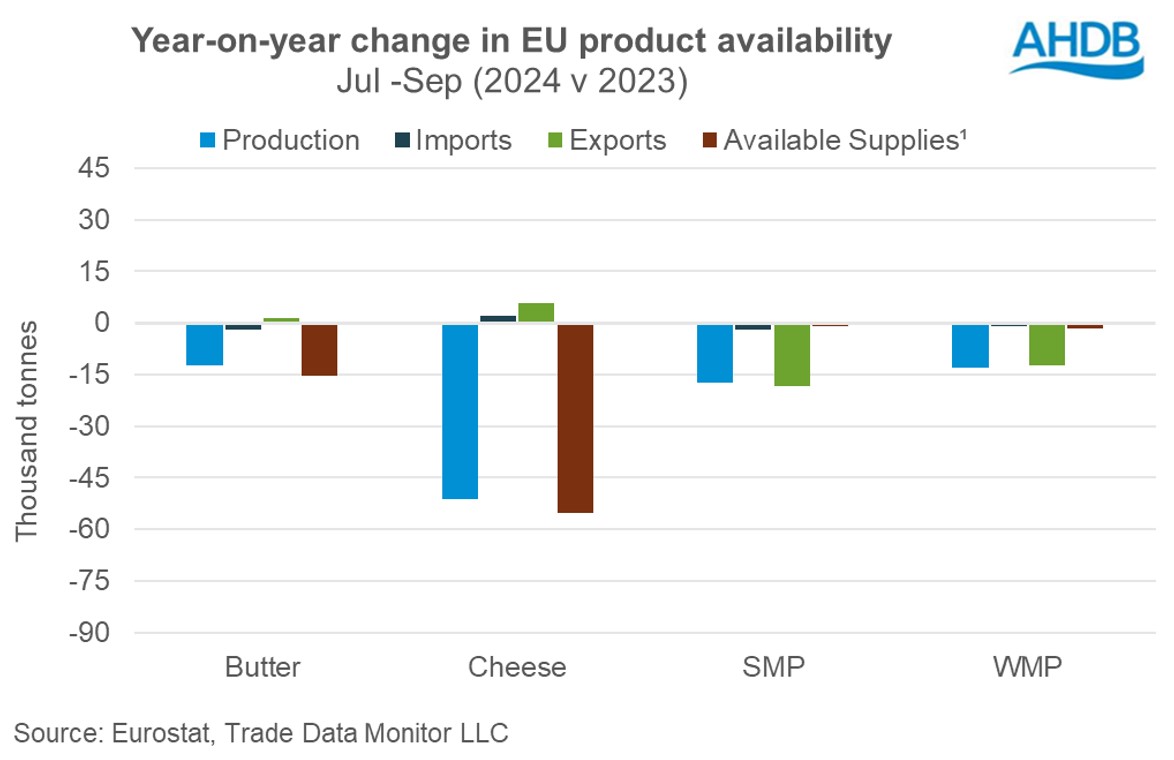

EU dairy product availability declined in Q3 2024 compared to the same period in 2023. Milk deliveries declined marginally by 0.2% in the third quarter year-on-year affecting the production of dairy products. Combined with increased exports, this tightened butter and cheese supplies. Lower production and imports also challenged the availability of milk powders. Consumers remain cautious in their buying approach and are hesitant to stock up.

Total dairy exports on the continent picked up by 0.4% in the third quarter year-on-year. Good demand for butter and cheese boosted exports while exports of milk powders continue to trade down amid subdued demand from China and the Middle-East. Higher powder prices compared to the global market weighed on exports.

Butter stocks continued to shrink

The decline in available butter supplies in Q3 resulted primarily from lower production and imports. Industry sources continued to report low stocks and high cream prices, which incentivised trade into other processing lines, therefore limiting product availability of butter. Good demand from retail added to the positive tone of the market.

Lower production and more exports drag down cheese supplies

Cheese supplies fell in Q3 2024 due to lower production and more exports. Competitive prices supported cheese exports during the period. An increase in exports was reported to the UK, the US and the Middle-East. However, a decline in exports to China limited the upside movement.

Supplies of powders trend down

SMP supplies declined by 0.7% year-on-year in Q3 2024. Production and imports declined by 5.3% and 19.2% respectively year-on-year. This was compensated for by exports being lower 9.4% year-on-year. China and other Asian countries including Malaysia, Indonesia and Vietnam were the major contributors to the decline, followed by the Middle-East.

WMP production declined in Q3 year-on-year in line with the decline in milk deliveries and lower demand in the global market. Increasing competitiveness from New Zealand is weighing on exports. Lower exports were reported to the UK, and countries in Asia and Africa. Available supplies declined modestly by 2.0% following lower production and imports.

1Available supplies = production + imports – exports

According to the latest short-term outlook report, the European Commission expects milk deliveries to increase 0.2% year-on-year in 2025, finely balancing between an increase in milk yields and the decline in the dairy herd. Overall, stable raw milk prices and easing input prices paint a brighter scenario for the farmers. However much depends on demand on the continent and global markets. Food inflation remains higher than general inflation and consumers remain cautious in their buying approach.

The overall macro-economic and geopolitical situation in the global market will influence trade flows accordingly. At the same time, there is increasing policy and legislative pressure to achieve national and EU-wide environmental objectives and to further increase animal welfare standards. Disease spread will be key watch point with the outbreak of Foot and Mouth disease in Germany. Blue tongue disease has already had a big impact in some areas.