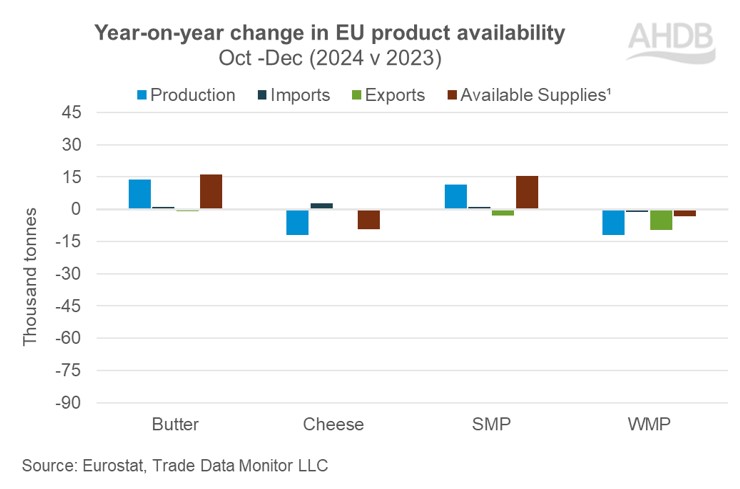

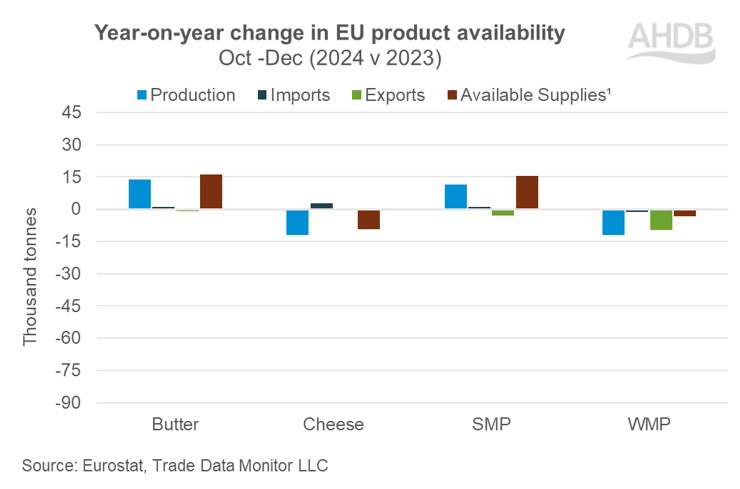

- Mixed movements in available supplies of EU’s dairy products

- Robust production growth of butter and SMP boost available supplies

- Cheese and WMP continue to trade down on lower production

Increases in production and imports of butter and SMP boosted available supplies in Q4 2024 compared to same period previous year. Meanwhile, available supplies of cheese and WMP receded amid lower production during the period. EU milk deliveries in the fourth quarter of the calendar year 2024 amounted to a marginal increase of 201m litres (0.6%) year on year. This supported the production growth of butter and SMP.

Total dairy exports on the continent edged up by 18.6% in the fourth quarter year on year. Of this, 80% of the increase in total exports constituted milk and cream and a slight increase in exports of yoghurt and whey. Exports to the United Kingdom, the United States and Asia increased. Exports of butter and WMP declined following higher prices in the global market.

Butter stocks grew

The increase in available butter supplies in Q4 resulted primarily from an increase in production. A marginal increase in imports also contributed. Higher prices affected competitiveness in the export market. Production volumes increased as availability of milk increased for churning. Paired with this, good demand in the domestic market during the holiday season also stimulated more production.

Drop in production decreased cheese supplies

Cheese stocks were lower in Q4 2024 driven by a large decline in production. Exports remained almost at par with year ago levels. Lack of good demand in the export market did not incentivise processors to push production. Demand in the domestic market remained stable.

Overall supplies of powders in positive territory

Availability of SMP supplies increased by 10.3% year on year in Q4 2024. Both production and imports increased by around 3.9% and 11.9% respectively during the period. Exports were lower by 2.1% year on year. Exports declined to the Middle East, South Africa and certain African and Asian countries.

WMP production declined year on year with processors utilising more milk supplies for the production of butter. Subdued demand from confectionary manufacturing weighed on prices. Lower exports were reported to the Middle East and some countries in Asia and Africa. Available supplies declined by 4.3% following lower production and imports.

1available supplies is defined as: production + imports – exports

According to latest Rabobank report, the EU economy is expected to grow by 1.2% in 2025 and demand for dairy is expected to be stable. Higher disposable incomes will provide for more spending, however inflationary pressures in the food and retail sector still remains a concern. On the supply side, milk production in medium -term (2024 -2035) is expected to decline 0.2% and 0.32% (Jan -Jun 2025) following declining herd size due to environmental, structural changes and outbreak of diseases. This will impact availability of dairy products.

The recent tariffs introduced by the Trump government will affect trade flows and exact situation will be clear in the coming weeks. Products will be displaced from the shelves depending on price competitiveness after the introduction of these tariffs which became effective 5th April. Disease outbreaks such as Bluetongue and Foot and Mouth disease (FMD) will continue to impact milk yields. How the market responds to these challenges will be key watchpoint going forward.