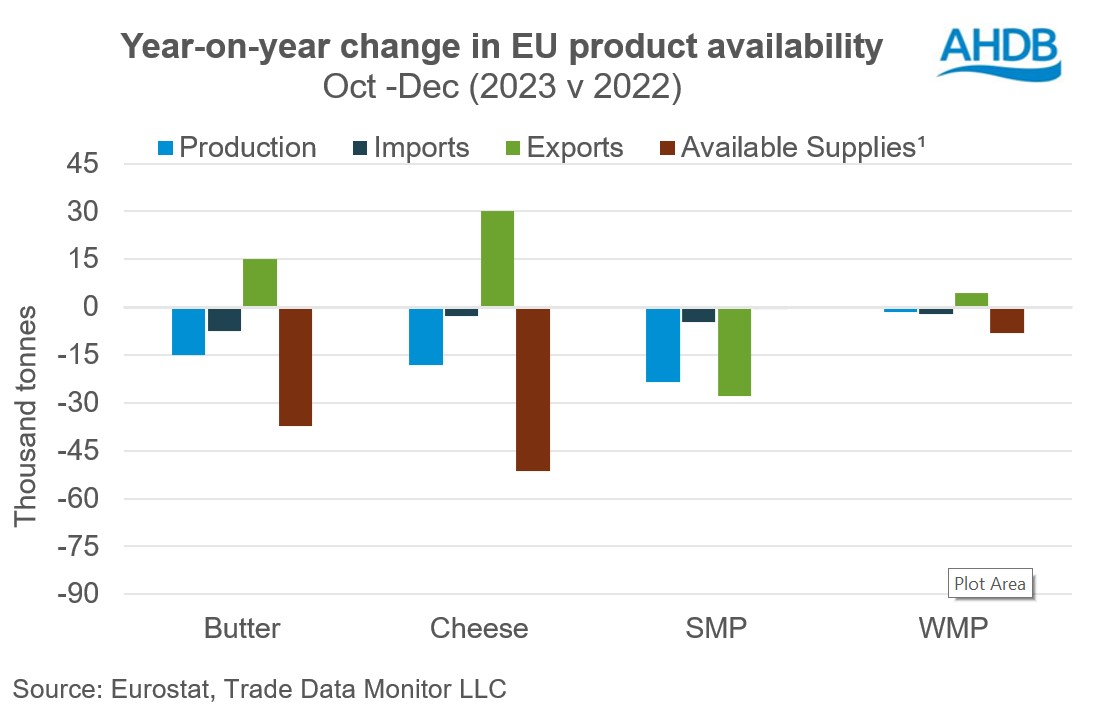

Key points:

- Lower production and improved exports drove available supplies lower

- Exports to China improved for butter and cheese

- Demand from MENA, US and China boosted EU exports

EU dairy product availability continued on a downward trajectory in Q4 2023 compared to the same period in 2022. Declines in production and improved exports tightened supplies. EU milk deliveries eased by 1.7% in the fourth quarter 2023 year-on-year basis meaning less dairy products were made. In addition, lower prices made EU dairy products more competitive in the export market. However, demand on the continent and global market remains lack-lustre challenged by inflationary pressures on consumers.

Despite this, exports of butter and cheese to China have witnessed an uptick during Q4 compared to a year ago. The boost in Chinese cheese consumption is likely to keep the wheels rolling forward. However, demand for milk powders from China remains subdued. Along with China, exports to US have also grown during the period. Demand from the Middle East, Southeast Asia and Africa continues to be strong.

Butter

The decline in available supplies of butter was driven by lower production, imports and higher exports in Q4. The decline in milk prices and unfavourable weather conditions impacted milk volumes which, in turn, affected the availability of cream for butter production. Demand fulfilment during the Christmas season bolstered exports.

Cheese

Cheese supplies trended down in Q4 2023, driven by a reduction in production, relatively lower imports and robust growth in exports. Demand for cheese has increased as economic conditions are improving. Demand from Australia, China, South Africa, U.A.E and US boosted exports.

Powders

SMP supplies declined by 0.3% year-on-year in Q4 2023. Declines in production and imports were largely offset by lower exports, which were reported to be lower by 15% year-on-year. Domestic buying was also reported to be sluggish.

Availability of WMP also tightened, with supplies declining by 9% year-on-year. Production fell by 1% due to lower milk deliveries. Most of the WMP was made to fulfil contracts. Lower imports and production, coupled with higher exports, tightened available supplies. Exports picked up to countries in the Middle East (Yemen, Israel), Saudia Arabia and Africa (Algeria, Congo, Liberia, Morocco, Nigeria, Tunisia). However, hopes of increasing WMP exports to China stand unfulfilled.

Drivers on both the supply and demand side will impact product availability. According to the European Commission’s latest agricultural report, the EU dairy herd size will decline in the medium to long-term following stricter EU and national environment policies. This does not paint an encouraging panorama for milk production and would reduce EU milk production by 0.2% per year on average between 2024 and 2035. Demand also continues to be lack-lustre due to the squeeze on consumer wallets from rising costs and inflation.

1Available supplies = production + imports – exports