Key points

- Milk deliveries forecast to increase 0.3% year on year in 2023 on the back of increased yields

- Exports of key products expected to grow as a result of competitive pricing

- Domestic demand remains weak amidst continued inflationary pressures

- Input costs remain high despite easing from last year’s price peaks

Raw Milk

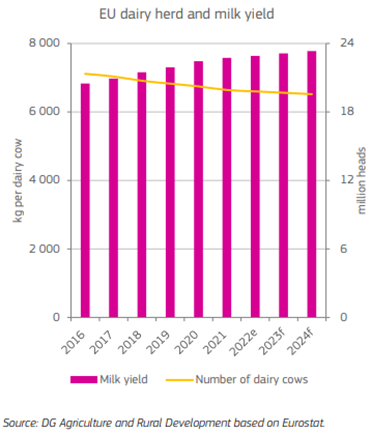

In the latest EU short term outlook the European Commission anticipates milk deliveries in the region to end the year up 0.3% year on year despite lower cow numbers and declining milk prices. Weather conditions have been reported as more favourable than those experienced last year which has contributed to better feed quality and in turn supported milk yields (+1.0%). The forecast for 2024 is for milk deliveries to remain relatively steady (+0.2%) year on year.

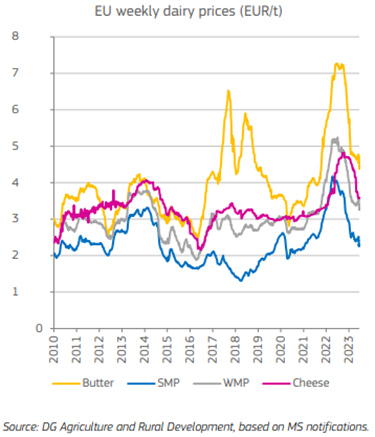

Milk prices have been declining since the beginning of the year, although the rate of decline has slowed down since summer. The average milk price in August is reported as down 25% from the December peak. The largest declines have been reported in Ireland (-43%), with France, Italy and Spain only decreasing by c.10%. Although food price inflation has started to decrease, higher prices continue to constrain demand, both domestically and globally. This weaker demand and continuing price decreases on commodity markets are underpinning lower milk prices.

The size of the dairy herd may continue to decline by another 0.6%. Although this is a continuation of a longer-term trend, the short-term changes are driven by lower milk prices and higher inputs costs causing farm margins to tighten.

Dairy Products

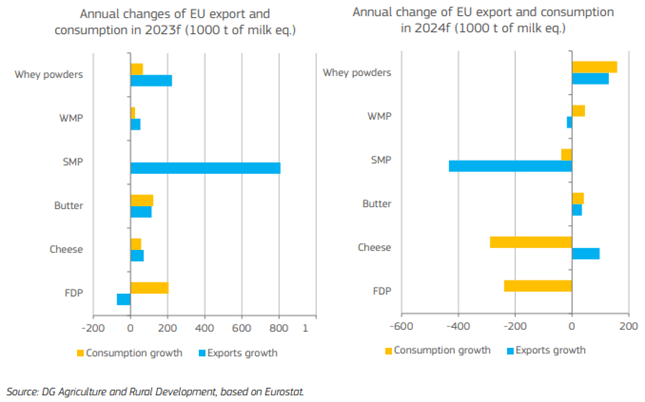

As milk deliveries are expected to increase so is the production of dairy products. Cheese and whey production are expected to be up 1.0% and 1.2% respectively in 2023, more marginal growth is anticipated for butter up 0.3% year on year. Meanwhile, the negative trends seen earlier this year in SMP and WMP production may be counteracted by greater volumes in the latter part of the year, resulting in an overall stable picture.

In 2024, it is forecast that cheese, whey and butter may still record growth in production volumes, albeit more marginal, following marginal growth in milk deliveries. However, milk powders are forecast to revert back into decline as both export and domestic demand ease.

In terms of exports, increased production and lower pricing is likely to result in an uplift for all products in 2023. Year on year, the EU commission is forecasting exports of cheese, butter SMP and WMP to be up between 1.5 – 15%. Looking ahead to 2024 is a more mixed picture. Export growth may continue but at a more subdued rate for cheese, whey and butter, while powders may record year on year declines in traded volume.