|

|

5-day change | 1st Jan Change | ||

|

3.800 NZD |

+1.33% |

|

+8.88% |

+52.61% |

September 30, 2024 at 02:20 am EDT

Global Dairy

UPDATE

|

Our Markets |

Our Performance |

New Zealand and Australia monthly production increased. EU and US monthly production decreased.

Australia, EU and US monthly exports increased. New Zealand monthly exports decreased.

Fonterra continues momentum in FY24, announces special dividend.

For further details, visit our website –

CLICK HERE

Asia and Latin America monthly imports increased. Middle East & Africa and China monthly imports decreased.

Fonterra New Zealand’s collections for August were 98.0 million kgMS, 9.3% above August last season. Season-to-date collections are-

- million kgMS, 7.9% above last season.

Fonterra’s Australia collections in August were 7.0 million kgMS, 3.6% above August last season. Season-to-date collections are-

- million kgMS, 0.9% above last season.

Our Co-op

• Fonterra’s revised strategy to grow end-to-end value.

Key Dates

|

14 November 2024 |

18 November 2024 |

|

Fonterra Co-operative Group Annual Meeting |

Fonterra Shareholders’ Fund Annual Meeting |

|

New Plymouth |

Auckland |

OUR MARKETS

Global Production

To view a chart that illustrates year-on-year changes in production –

New Zealand and Australia monthly production increased. EU and US monthly production decreased

CLICK HERE

NEW ZEALANDAUSTRALIAEUROPEAN UNION USA

|

% |

3.4 |

% |

% |

0.4 |

% |

|

11.8 |

0.5 |

||||

|

Change for August 2024 |

Change for June 2024 |

Change for July 2024 |

Change for July 2024 |

||

|

compared to August 2023 |

compared to June 2023 |

compared to July 2023 |

compared July 2023 |

||

|

% |

3.1 |

% |

% |

% |

|

|

0.2 |

0.2 |

0.5 |

Change for the 12 months to August 2024

Change for the 12 months to June 2024

Change for the 12 months to July 2024

Change for the 12 months to July 2024

New Zealand milk production increased 11.8% on a litres basis (up 10.0% on milk solids basis) for August compared to the same period the year prior.

The production increase was mainly due to favourable weather and pasture conditions and early calving.

New Zealand milk production for the

12 months to August was up 0.2% on the previous comparable period.

Fonterra New Zealand collections are reported for August, see page 5 for details.

Australia milk production increased 3.4% in June compared to the same period the year prior.

The production increase was mainly due to favourable weather conditions in Northern and Eastern Victoria, partially offset by colder weather affecting production in Western Victoria and Tasmania.

Australia milk production for the 12 months to June was up 3.1% on the previous comparable period.

Fonterra collections in Australia are reported for August, see page 5 for details.

EU milk production¹ decreased 0.5% in July compared to the same period the year prior.

The production decrease was mainly driven by the impact of Bluetongue disease, with environmental regulation and health challenges lowering milk output from Germany, Ireland, and the Netherlands. Additionally, European milk prices continued to increase due to higher seasonal demand for dairy products.

EU milk production for the 12 months to July was up 0.2% on the previous comparable period.

US milk production decreased 0.4% in July compared to the same period the year prior.

The production decrease was mainly driven by smaller herd sizes and decreased milk yield per cow due to a avian flu outbreak and heat stress affecting the country. This was partially offset by higher milk yields in Texas and Kansas.

US milk production for the 12 months to July was down 0.5% on the previous comparable period.

OUR MARKETS

Global Exports

Australia, EU and US monthly exports increased. New Zealand monthly exports decreased

To view a chart that illustrates year-on-year changes in exports –

CLICK HERE

NEW ZEALANDAUSTRALIAEUROPEAN UNION USA

|

% |

13.2% |

8.8% |

9.6% |

|

12.0 |

|||

|

Change for August 2024 |

Change for July 2024 |

Change for July 2024 |

Change for July 2024 |

|

compared to August 2023 |

compared to July 2023 |

compared to July 2023 |

compared to July 2023 |

|

1.1% |

5.6% |

1.9% |

1.7% |

Change for the 12 months to August 2024

Change for the 12 months to July 2024

Change for the 12 months to July 2024

Change for the 12 months to July 2024

New Zealand dairy exports decreased 12.0%, or 20,837 MT, in August compared to the same period last year.

The decrease was mainly due to lower export volumes of WMP, fluid milk products and butter. This was partially offset by slightly higher export volumes of infant formula to Japan and Saudi Arabia.

Exports for the 12 months to August were up 1.1%, or 38,217 MT, on the previous comparable period.

This was mainly due to high export volumes of WMP to Indonesia and the Middle East, alongside SMP to Southeast Asia.

Australia dairy exports increased 13.2%, or 6,907 MT, in July compared to the same period the year prior.

The increase was mainly due to the prior year’s low export volumes of SMP and powders, resulting from the mismatch between domestic milk prices and global commodity prices.

Exports for the 12 months to July were up 5.6%, or 36,989 MT, on the previous comparable period.

This was mainly due to higher export volumes of SMP and cheese, due to Australia’s increased levels of production resulting in more exportable surplus.

EU dairy exports increased 8.8%, or 48,651 MT, in July compared to the same period the year prior.

The increase was mainly due to higher export volumes of whey, butter and cheese to the US, Indonesia, and the Philippines, alongside record whey export volumes to China.

Exports for the 12 months to July were down 1.9%, or 126,847 MT, on the previous comparable period.

This was mainly due to lower export volumes of infant formula, SMP and cultured products to key markets such as China, driven by competition from New Zealand origin products.

US dairy exports increased 9.6%, or

21,406 MT, in July compared to the same period the year prior.

The increase was mainly due to high export volumes of cheddar to Mexico and South Korea, alongside high export volumes of whey to meet ongoing strong demand from Southeast Asia.

Exports for the 12 months to July were down 1.7%, or 48,860 MT, on the previous comparable period.

This was mainly due to ongoing lower export volumes of American powder products as demand from key markets remains low. This was partially offset

by high export volumes of cheese to Mexico.

OUR MARKETS

Global Imports

To view a chart that illustrates year-on-year changes in imports –

Asia and Latin America monthly imports increased. Middle East & Africa and China monthly imports decreased

CLICK HERE

LATIN AMERICAASIAMIDDLE EAST & AFRICA CHINA

|

14.0 |

23.4 |

13.2 |

2.1 |

% |

||

|

% |

% |

% |

||||

|

Change for July 2024 |

Change for July 2024 |

Change for July 2024 |

Change for August 2024 |

|||

|

compared to July 2023 |

compared to July 2023 |

compared to July 2023 |

compared to August 2023 |

|||

|

6.3 |

% |

% |

2.4 |

% |

% |

|

|

10.0 |

11.4 |

Change for the 12 months to July 2024

Change for the 12 months to July 2024

Change for the 12 months to July 2024

Change for the 12 months to August 2024

Latin America dairy import volumes¹ increased 14.0%, or 29,363 MT, in

July compared to the same period the year prior.

The increase was mainly due to higher import volumes of cheese by Mexico and Brazil, and WMP by Venezuela.

Imports for the 12 months to July were up 6.3%, or 153,223 MT, on the previous comparable period.

This was mainly due to ongoing high import volumes of cheese by Mexico and Brazil, alongside increased import volumes of fluid milk products by the Dominican Republic.

Asia (excluding China) dairy import volumes¹ increased 23.4%, or

95,818 MT, in July compared to the same period the year prior.

The increase was mainly due to ongoing high import volumes of fluid milk products and whey to Southeast Asia.

Imports for the 12 months to July were up 10.0%, or 474,392 MT, on the previous comparable period.

This was mainly due to higher import volumes of WMP by Vietnam and Bangladesh, and fluid milk products by the Philippines.

Middle East and Africa dairy import volumes¹ decreased 13.2%, or

69,658 MT, in July compared to the same period the year prior.

The decrease was driven by lower import volumes of WMP and SMP by Algeria, partially offset by slightly higher import volumes of whey by Egypt and Nigeria.

Imports for the 12 months to July were up 2.4%, or 135,804 MT, on the previous comparable period.

This was mainly due to ongoing higher import volumes of fluid milk products by the UAE, and SMP by Saudi Arabia and Egypt.

China dairy import volumes decreased by 2.1%, or 5,177 MT, in August compared to the same period the year prior.

The decrease was driven by lower import volumes of WMP, SMP and AMF from Oceania. This was partially offset by higher import volumes of whey from the US.

Imports for the 12 months to August were down 11.4%, or 363,935 MT, on the previous comparable period.

This was mainly due to an ongoing decline in import volumes of SMP, WMP, fluid milk products and infant formula.

1 Estimates are included for those countries that have not reported data.

OUR MARKETS

Fonterra Milk Collections

To view a table that shows detailed milk collections in New Zealand and Australia compared to the previous season –

New Zealand Milk Collections

|

• |

|

|

• |

|

|

LITRESDAY |

|

|

M |

|

|

VOLUME |

|

|

JUN |

JUL |

AUG |

SEP |

OCT |

NOV |

DEC |

JAN |

FEB |

MAR |

APR |

MAY |

CLICK HERE

NEW ZEALANDNORTH ISLANDSOUTH ISLANDAUSTRALIA

|

9.3% |

8.7% |

10.7% |

3.6% |

|||

|

Change for August 2024 |

Change for August 2024 |

Change for August 2024 |

Change for August 2024 |

|||

|

compared to August 2023 |

compared to August 2023 |

compared to August 2023 |

compared to August 2023 |

|||

|

% |

8.8 |

% |

5.2 |

% |

0.9 |

% |

|

7.9 |

Season-to-date 1 June to 31 August compared to prior season

Season-to-date 1 June to 31 August compared to prior season

Season-to-date 1 June to 31 August compared to prior season

Season-to-date 1 July to 31 August compared to prior season

Fonterra’s New Zealand collections for August were

98.0 million kgMS, 9.3% above August last season.

The increase was mainly due to improved weather and soil conditions, in addition to farmers across the nation calving earlier in the season resulting in an uplift in the milk curve.

Season-to-date collections are 133.0 million kgMS, 7.9% above last season.

North Island milk collections in August were

70.0 million kgMS, 8.7% above August last season.

The increase was mainly due to ongoing favourable weather and soil conditions across the region, contributing to strong pasture growth and continued improvements in milk yields compared to last year.

Season-to-date collections are 100.7 million kgMS, 8.8% above last season.

South Island milk collections in August were

28.0 million kgMS, 10.7% above August last season.

The increase was mainly due to improved soil moisture levels across the region. Longer sunlight hours and warmer temperatures have also resulted in healthy pasture growth.

Season-to-date collections are 32.3 million kgMS, 5.2% above last season.

Fonterra’s Australia collections in August were

7.0 million kgMS, 3.6% above August last season.

The increase was mainly due to favourable weather conditions in Northern and Eastern Victoria, supporting strong pasture growth and reduced reliance on conserved fodder.

Season-to-date collections are 12.5 million kgMS,

0.9% above last season.

OUR MARKETS

Fonterra Global Dairy Trade Results

Fonterra GDT results at trading event 364

17 September 2024:

|

% |

USD |

3,891 |

000′ MT |

|

|

0.6 |

36.5 |

|||

|

Change in Fonterra’s |

Fonterra’s weighted |

Fonterra product quantity |

||

|

weighted average product |

average product price |

sold on GDT |

||

|

price from previous event |

(USD/MT) |

CHEDDARSMPWMP

|

% |

% |

1.5 |

% |

||

|

2.7 |

2.4 |

||||

|

USD 4,441/MT |

USD 2,810/MT |

USD 3,441/MT |

|||

|

AMF |

BUTTER |

||||

|

% |

% |

||||

|

1.2 |

2.2 |

Fonterra GDT sales

by destination:

To view more information, including a snapshot of the rolling year-to-date results –

USD 7,220/MTUSD 6,409/MT

|

LATEST AUCTION |

FINANCIAL |

|

|

YEAR-TO-DATE |

||

|

NORTH ASIA (INCLUDING CHINA) |

||

|

SOUTH EAST ASIA |

||

|

MIDDLE EAST AND AFRICA |

36,540 |

140,119 |

|

MT |

MT |

|

|

LATIN AMERICA |

||

|

OTHER |

CLICK HERE

The next trading event will be held on 1 October 2024. Visit www.globaldairytrade.info for more information.

Dairy commodity prices and New Zealand dollar trend

The US Federal Reserve Bank (Fed) initiated their long-awaited easing cycle with a 0.5% reduction to official interest rates in September, seeking to offset developing weakness in the labour market as the US economy slowly deflates following a post-pandemic boom. New Zealand’s economic data continues to show broad weakness – the economy contracting by 0.2% in the second quarter of this year, and by 0.5% in the year to June. While some early positive signs are beginning to emerge, such as a firming in dairy, beef and lamb prices, the Reserve Bank of New Zealand is expected to provide further monetary policy accommodation in the coming months, as is the US Fed.

|

, |

.•• |

|

|

, |

.• |

|

|

INDEX |

, |

.• |

|

PRICE |

||

|

. |

||

|

. |

||

|

SEP JAN APR |

JUL NOV FEB JUN SEP |

|

|

GDT PRICE INDEX |

NZDUSD SPOT RATE |

Fonterra continues momentum in FY24, announces special dividend

Fonterra Co-operative Group Ltd reported strong FY24 full year financial results, including a final 2023/24 season Farmgate Milk Price of $7.83 per kgMS and a total dividend of 55 cents per share.

CEO Miles Hurrell says the payout reflects both Fonterra’s continued strong earnings performance and the long-term resilience of the Co-op.

“We’ve maintained the positive momentum seen in FY23 and delivered earnings at the top end of our forecast range. Our total dividend of 55 cents per share is the second largest since Fonterra was formed. It includes a 15 cent interim dividend and a 25 cent final dividend driven by strong FY24 earnings.

“In addition, our capital management efficiency and ongoing balance sheet strength have enabled us to return an extra 15 cents per share to farmer shareholders and unit holders through a special dividend. The final Farmgate Milk Price for the 2023/24 season finished

at $7.83 per kgMS. This, combined with the 55 cents per share dividend, provides a total cash payout to a fully shared up farmer of $8.38 per kgMS.

“Our Co-op is in good shape, and I’m pleased to have delivered another year of solid returns to farmer shareholders and unit holders. Looking ahead, we’re well placed to consider the next phase of our strategy to grow long-term value for the Co-op,” says Mr Hurrell.

The Co-op reported a return on capital for FY24 of 11.3%, above the target range for

FY24. Earnings (EBIT) from continuing operations were $1,560 million and continue to be well above previous years, albeit down on FY23 which benefitted from elevated price relativities. Fonterra’s profit after tax from continuing operations was $1,168 million, equivalent to 70 cents per share.

“Our FY24 earnings were driven by higher margins and increased sales volumes in our Foodservice and Consumer channels. Our Ingredients channel also continued to deliver strong returns, although down when compared to the record result seen in FY23,” says Mr Hurrell.

Sales volumes from continuing operations were down 1% to 3,470 kMT and gross margins were maintained at 17%. “We remain focused on making progress against our two efficiency metrics while also investing in the areas that will improve long-term performance and the resilience of the Co-op.

“Our core operations manufacturing costs per kgMS reduced year-on-year by 2% to $2.58 per kgMS, reflecting both operational improvements and improved input costs. Across the year we also achieved savings

in our operating expenses which largely offset the impacts of inflation. However, our cash operating expenses per kgMS are

up mainly due to our investment in IT and digital transformation projects.

“Our balance sheet position remains strong, providing optionality and flexibility for the future and resilience against volatility. We have

net debt of $2.6 billion, $600 million lower than last year, due to strong underlying operating performance. Our gearing ratio of 24% reflects our lower net debt position and higher equity from strong earnings,” says Mr Hurrell.

This year, Fonterra completed a strategic review that reinforced the role of its Foodservice and Ingredients channels and confirmed its strengths in partnering with customers to produce world-class, innovative dairy. As a result of this work, in May the Co-op announced that it is exploring divestment options for its global Consumer business, as well as Fonterra Oceania and Sri Lanka.

“Over the last few months, we have appointed advisors to assist with assessing divestment options for our Consumer businesses and this work is ongoing,” says Mr Hurrell.

“As we can see from today’s result, the businesses

in scope for potential divestment are performing well. We remain committed to a pathway that would maximise value of these businesses for our farmer shareholders and unit holders. Alongside this, we have revised our strategy to have a sharper focus on the Co-op’s strengths and where we can best create value. “We will be sharing this revised strategy, as well as the outcomes shareholders and unit holders can expect from the Co-op, next week,” says Mr Hurrell.

Fonterra’s revised strategy to grow end-to-end value

Fonterra Co-operative Group Ltd released its revised strategy, which will see the Co-op deepen its focus on its high-performing Ingredients and Foodservice businesses to grow value for farmer shareholders and unit holders. This follows a strategic review that confirmed the Co-op’s strengths as a B2B dairy nutrition provider, resulting in Fonterra’s decision

to explore divestment options for its global Consumer businesses.

Chairman Peter McBride says the revised strategy creates a pathway to greater value creation, allowing the Co-op to announce enhanced financial targets and policy settings. The Coop exists to provide stability and manage risk on farmers’ behalf, while maximising the returns to farmers from their milk and the capital they have invested in Fonterra. Through implementation of our strategy, we can grow returns to our owners while continuing to invest

in the Co-op, maintaining the financial discipline and strong balance sheet we’ve worked hard to build over recent years.

“We have increased our target average return on capital to 10-12%, up from

9-10%, and announced a new dividend policy of 60-80% of earnings, up from 40-60%.

At all times, we remain committed to maintaining the maximum sustainable Farmgate Milk Price,” says Mr McBride. CEO Miles Hurrell says Fonterra is in a strong position, delivering results well above its five- year average, which puts it in a position to think about the next evolution of its strategic delivery.

“The foundations of our strategy – our focus on New Zealand milk, sustainability, and dairy innovation and science – remain unchanged. What’s changed is how we play to these strengths. Following our recent strategic review, we are clear on the parts of the business that create the

most value today and where there is further headroom for growth. These are our innovative Ingredients and Foodservice businesses, supported by efficient and flexible operations. By streamlining the Co-op to focus on these areas, we can grow greater value for farmer shareholders and unit holders, even if we divest our Consumer businesses,” says Mr Hurrell.

Looking out to the next decade and beyond, Fonterra has made six strategic choices. These are:

Deliver the strongest farmer offering

– work alongside farmers to enable on- farm profitability and productivity and support the strongest payout.- Unleash the Ingredients engine – deepen Fonterra’s position as a world-leading provider of sophisticated dairy ingredients and build trading capability to grow both the Farmgate Milk Price and earnings.

- Keep up the momentum in Foodservice – expand our successful Foodservice business in China and other key markets to grow earnings.

Invest in operations for the future – an efficient manufacturing and supply chain network that allows flexibility to allocate milk to the highest returning product and sales channel.

Build on our sustainability position

further improve the Co-op’s sustainability credentials and strengthen partnerships with customers who value this position.

6. Innovate to drive

an advantage – use science and technology to solve the Co-op’s challenges and build on competitive advantages.

“As previously announced, we are exploring divestment options for our global Consumer businesses to free up capital and allow the Co-op to focus on what it does best. This process is ongoing and progressing well. It remains our intention to seek shareholder approval prior to divesting these businesses,” says Mr Hurrell.

“The Co-op’s improved returns will primarily be driven by increased earnings in Ingredients and Foodservice along with operational efficiencies. We continue to have significant capital investment needs ahead of us to maintain

fit for purpose assets and we can meet these investment requirements while maintaining our strong balance sheet. We also intend to make a significant capital return to shareholders if we divest our

Consumer business,” says Mr Hurrell.

Fonterra will provide farmers and the market a rolling three-year forward- looking view of the financial assumptions underpinning its performance targets annually and will measure progress through its annual business updates.

“This is the right strategy for the Co-op. It has a clear-eyed view of where we best generate returns for farmer shareholders and unit holders and will see us unlock value at every point in our supply chain by focusing on our strengths. Together, Fonterra’s Board and Management are looking forward to working alongside our Co-op’s farmers and employees to deliver on our vision to be the source of the world’s most valued dairy,” says Mr Hurrell.

Supplementary Information

Global Dairy Market

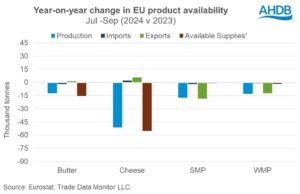

The charts on the right illustrate the year-on-year changes in imports, exports and production for a range of countries that are important players in global dairy trade.

The absolute size of the bars represents the change in imports, exports or production, relative

to the same period the previous year.

Averages are shown where data is complete for the regions presented.

BACK TO SUMMARY

BACK TO SUMMARY

PRODUCTION

|

SEP OCT NOV |

DEC JAN |

FEB MAR |

APR MAY JUN |

JUL AUG |

|||||||

|

NEW ZEALAND |

EU |

UNITED STATES |

AUSTRALIA |

AVERAGE |

|||||||

NOTE: Data for Australia to June; EU and US to July; New Zealand to August.

EXPORTS

|

• |

|

|

• |

|

|

s |

|

|

MT |

|

|

• |

|

|

• |

|

|

•• |

|

SEP OCT NOV |

DEC JAN |

FEB MAR |

APR MAY JUN |

JUL AUG |

|||||||

|

NEW ZEALAND |

EU |

UNITED STATES |

AUSTRALIA |

AVERAGE |

|||||||

NOTE: Data for EU, US and Australia to July; New Zealand to August.

IMPORTS

|

SEP |

OCT NOV DEC |

JAN FEB MAR APR |

MAY JUN |

JUL AUG |

||||||

|

MIDDLE EAST & AFRICA |

LATIN AMERICA |

AVERAGE |

||||||||

|

ASIA |

CHINA |

|||||||||

NOTE: Data for Asia, Middle East & Africa, Latin America to July; China to August.

SOURCES: Government milk production statistics (DCANZ, Dairy Australia, Eurostat, USDA)/GTA trade data/Fonterra analysis.

Disclaimer

Fonterra Co-operative Group Limited published this content on September 30,

2024 and is solely responsible for the information contained herein. Distributed by Public, unedited and unaltered, on September 30,

2024 at

06:19:13 UTC.

|

New Zealand Shares Slip into Red; Fletcher Building Gains 8% |

12:43am |

MT |

|

Fonterra Co-op Upgrades Dividend Policy; Shares Rise 3% |

06:40pm |

MT |

|

Fonterra Co-operative Group Limited Reports Earnings Results for the Full Year Ended July 31, 2024 |

Sep. 25 |

CI |

|

New Zealand Shares Extend Losses; Fonterra Co-operative Group Hits 52-Week High |

Sep. 25 |

MT |

|

Fonterra Co-operative Group Limited, 2024 Earnings Call, Sep 25, 2024 |

Sep. 24 |

|

|

Fonterra Co-operative Posts 7% Decline in Fiscal 2024 Revenue, Lifts 2024/2025 Milk Price; Shares Hit New 52-Week High |

Sep. 24 |

MT |

|

Fonterra to Build Cool Store in Taranaki for NZ$150 Million |

Sep. 18 |

MT |

|

KKR, Permira Reportedly Eye Fonterra Assets |

Aug. 15 |

CI |

|

Leonie Guiney to Retire from the Board of Fonterra |

Aug. 08 |

CI |

|

Jarden, JPMorgan, Craig’s Reportedly Tapped by Fonterra on Sale of Assets |

Jul. 25 |

CI |

|

Tasmanian ‘Eco-Milk’ tests shoppers’ thirst for climate-friendly dairy |

Jul. 22 |

RE |

|

UBS Reportedly Heads Race for Fonterra Deal |

Jul. 16 |

CI |

|

China’s Li pays ‘very positive’ visit to Fonterra, New Zealand minister says |

Jun. 14 |

RE |

|

European dairy, pork producers wary of Chinese retaliation for EV tariffs |

Jun. 13 |

RE |

|

European dairy, pork producers wary of Chinese retaliation for EV tariffs |

Jun. 13 |

RE |

|

Neutral Foods, Inc. acquired Zeal Creamery from Fonterra, Canterbury Grasslands Limited and others. |

Jun. 10 |

CI |

|

Fonterra Co-Operative Group Limited Revises Earnings Guidance for the Year 2024 |

May. 28 |

CI |

|

Fonterra Co-operative Group Limited, Q3 2024 Earnings Call, May 29, 2024 |

May. 28 |

|

|

Fonterra Co-operative Group Limited Reports Earnings Results for the Nine Months Ended April 30, 2024 |

May. 28 |

CI |

|

S&P Backs Fonterra’s Move for Divestment |

May. 20 |

CI |

|

Australia shares jump as US inflation data reinforces rate-cut hopes |

May. 15 |

RE |

|

Metrovate announced that it has received $1 million in funding |

May. 15 |

CI |

|

Fonterra Co-operative Group Limited’s Equity Buyback announced on July 27, 2023 has expired. |

May. 15 |

CI |

|

NZ dairy giant Fonterra plans to sell its consumer arms |

May. 15 |

RE |

|

Metrovate announced that it has received NZD 1 million in funding from OurCrowd Ltd., Finistere Ventures, LLC, Sprout Agritech Ltd, Fonterra Co-operative Group Limited, Callaghan Innovation |

May. 13 |

CI |

FCG: Dynamic Chart

Fonterra Co-operative Group Limited is a New Zealand-based dairy co-operative company. The Company is primarily involved in the collection, manufacture and sale of milk and milk-derived products through its ingredients, consumer, and foodservice channels. It operates through three segments: Global Markets, Greater China, and Group Operations. The Global Markets segment represents the global ingredients, foodservice and consumer channels outside of Greater China. The Greater China segment represents the ingredients, foodservice and consumer channels in Greater China. The Group Operations segment represents the business activities from collecting and processing New Zealand milk, through to selling products to its customer-facing regional business units, Global Markets and Greater China. Its channel of branded consumer products includes powders, yoghurts, milk, butter, and cheese. The Companyâs brands include Anchor, Anmum, Anlene, and Chesdale, among others.

More about the company