A US team led by Brendan Lynch, the Deputy Assistant USTrade Representative for South and Central Asia, was in India last week. Amid President Donald Trump’s threats to impose reciprocal tariffs starting April 2, Indian officials discussed the bilateral trade agreement (BTA) with the team. Further negotiations are planned for different sectors. According to reports, agricultural products were also discussed during these talks. India had already reduced the import duty on Bourbon whiskey from 150 per cent to 100 per cent. Now, the import duties on almonds, walnuts, cranberries, pistachios, and lentils may also be reduced. In exchange, India wants to increase exports of rice and fruits to the US.

Due to the trade war, China, the largest importer of agricultural products from the US, is gradually reducing its dependence on the US. As a result, the US is looking for new markets to sell its products. According to the announcement made during the previous joint meeting between Prime Minister Narendra Modi and President Trump, both countries will finalize the bilateral trade agreement (BTA) by October. Meanwhile, the long-stalled Free Trade Agreement (FTA) negotiations with the European Union have also been restarted, with the goal of finalizing them this year. The US and Europe are among India’s largest trading partners, and we have significant agricultural trade with them. Experts suggest that in these trade talks, India should not deviate from its long-standing policy of protecting its agricultural sector.

According to experts, making agricultural imports easier will make it difficult for Indian farmers to compete with farmers from developed countries who receive heavy subsidies. Last week, on March 18, during the US On National Agriculture Day, Agriculture Secretary Brooke Rollins announced that under the Emergency Commodity Assistance Program (ECAP), his department would provide direct assistance of 10 billion dollars (approximately 85,000 crore rupees) to farmers for the 2024 crop year. He stated, “Farmers are facing high costs and market uncertainty, and the Trump administration has decided that farmers should receive the necessary assistance without delay. The US Department of Agriculture (USDA) wants to prioritize these payments to help farmers cope with rising expenses and ensure they have adequate financial resources before the next season.”

According to the US Department of Agriculture, there were 3.4 million farmers in the US in 2022. According to another report from March 2025, in 2024, there were a total of 1.88 million farms in the country, with a total area of 87.6 million acres. The average farm size was 466 acres.

If we look at the general ratio of the announced assistance amount to the number of farmers on Agriculture Day, each farmer in the US would receive 2.5 lakh rupees. In comparison, farmers in India receive only 6,000 rupees annually under the PM-KISAN scheme. Indian farmers also receive subsidies on fertilizers, crop insurance, crop loans but comparatively, agricultural subsidies in the U.S. and Europe are much higher. Each American farmer receives more than 26 lakh rupees annually in assistance from their government.

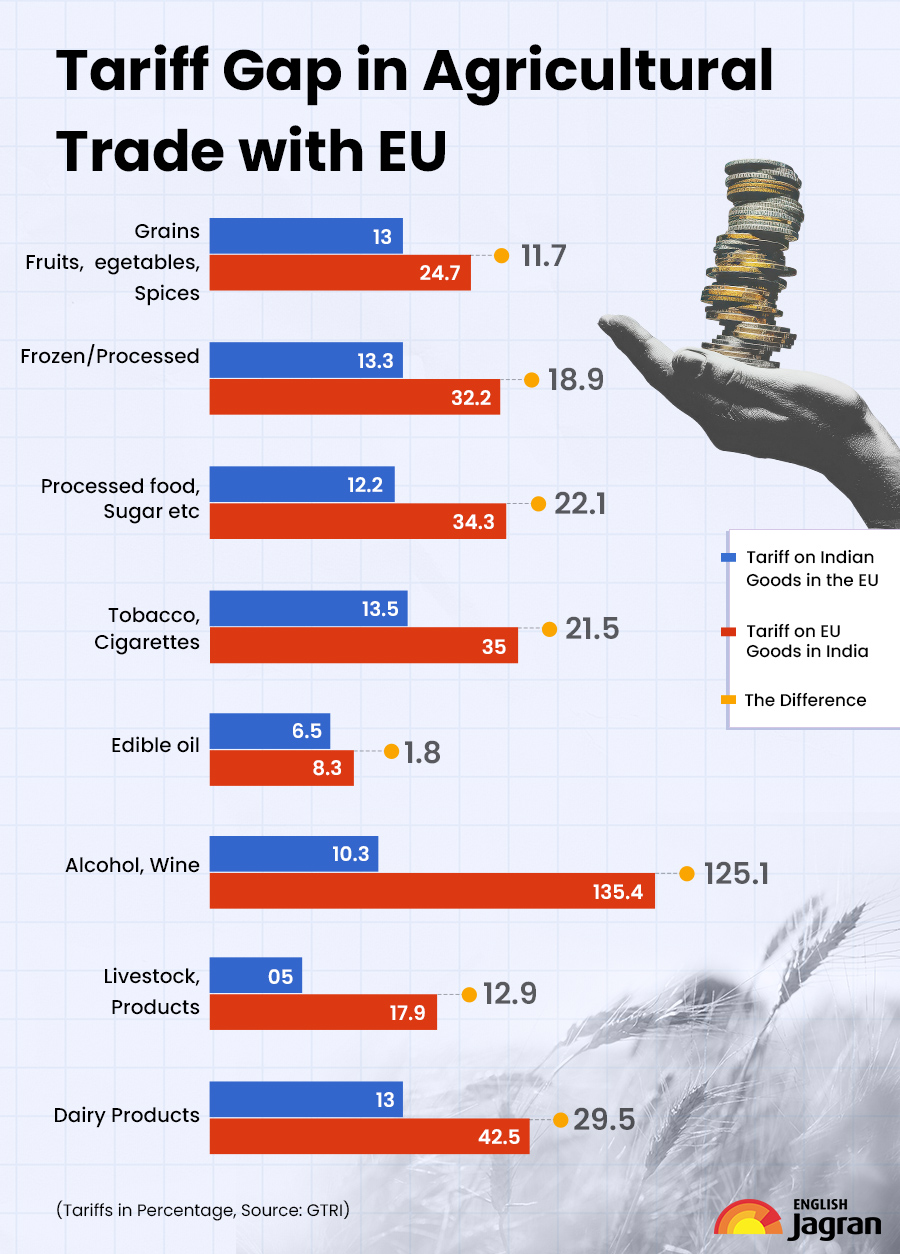

Differences in Agricultural Tariffs

Agriculture is a key issue in the India-US trade talks. The US wants India to reduce tariffs on agricultural imports. Under reciprocal tariffs, Trump has threatened to impose the same tariff on imports from other countries as they impose on US imports. Ajay Srivastava, founder of the research group Global Trade Research Initiative (GTRI) and an expert in foreign trade policy, tells Jagran Prime, “India’s average agricultural tariff is 37.7 per cent, while the US has 5.3 per cent. On paper, this difference may seem large, but the reality is a bit different. The US also imposes complex and opaque tariffs, which increase protection for its agriculture. In this context, the actual tariff difference is not as significant as it appears.”

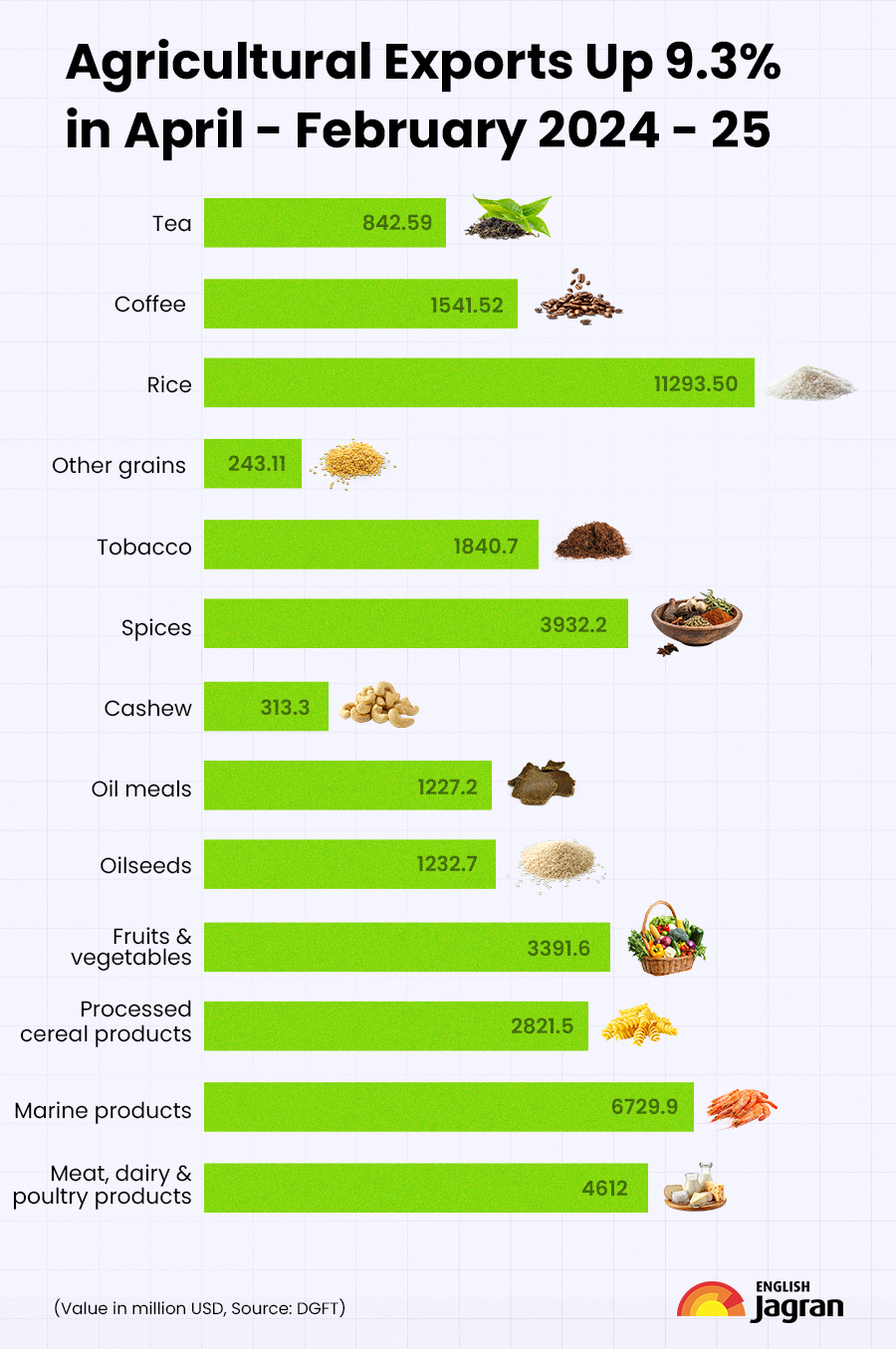

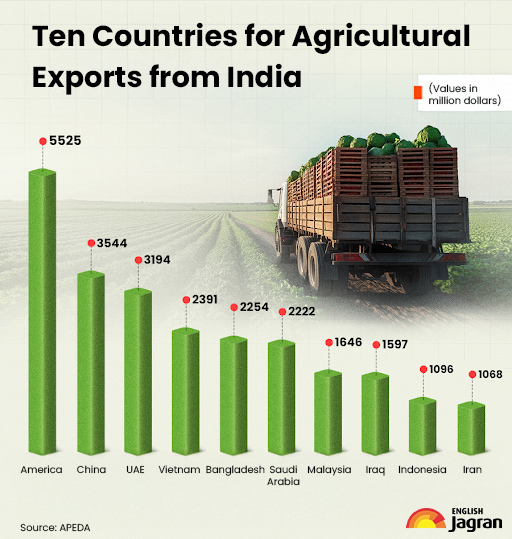

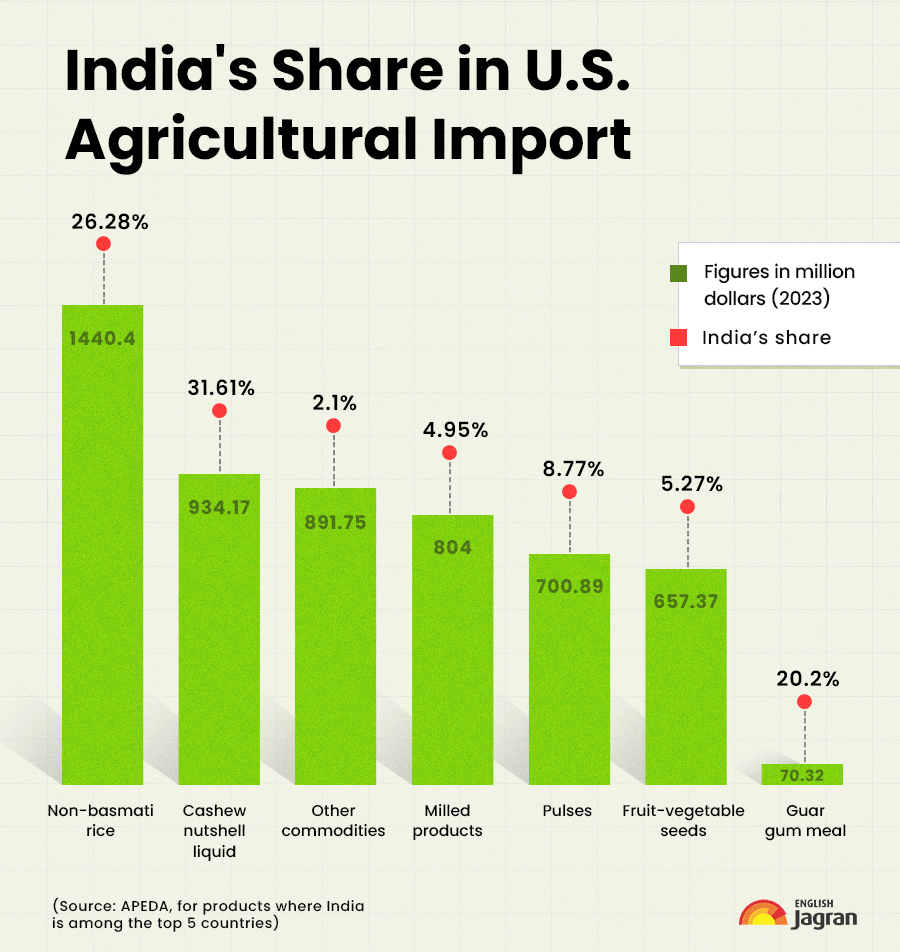

According to Srivastava, India’s agricultural exports to the U.S. for the calendar year 2024 were valued at 5.7 billion dollars. The highest exports were shrimp and prawns at 2.2 billion dollars, basmati and non-basmati rice at 386 million dollars, honey at 141.3 million dollars, vegetable extracts at 399.2 million dollars, psyllium husk at 148.4 million dollars, castor oil at 106.2 million dollars, and black pepper at 180 million dollars.

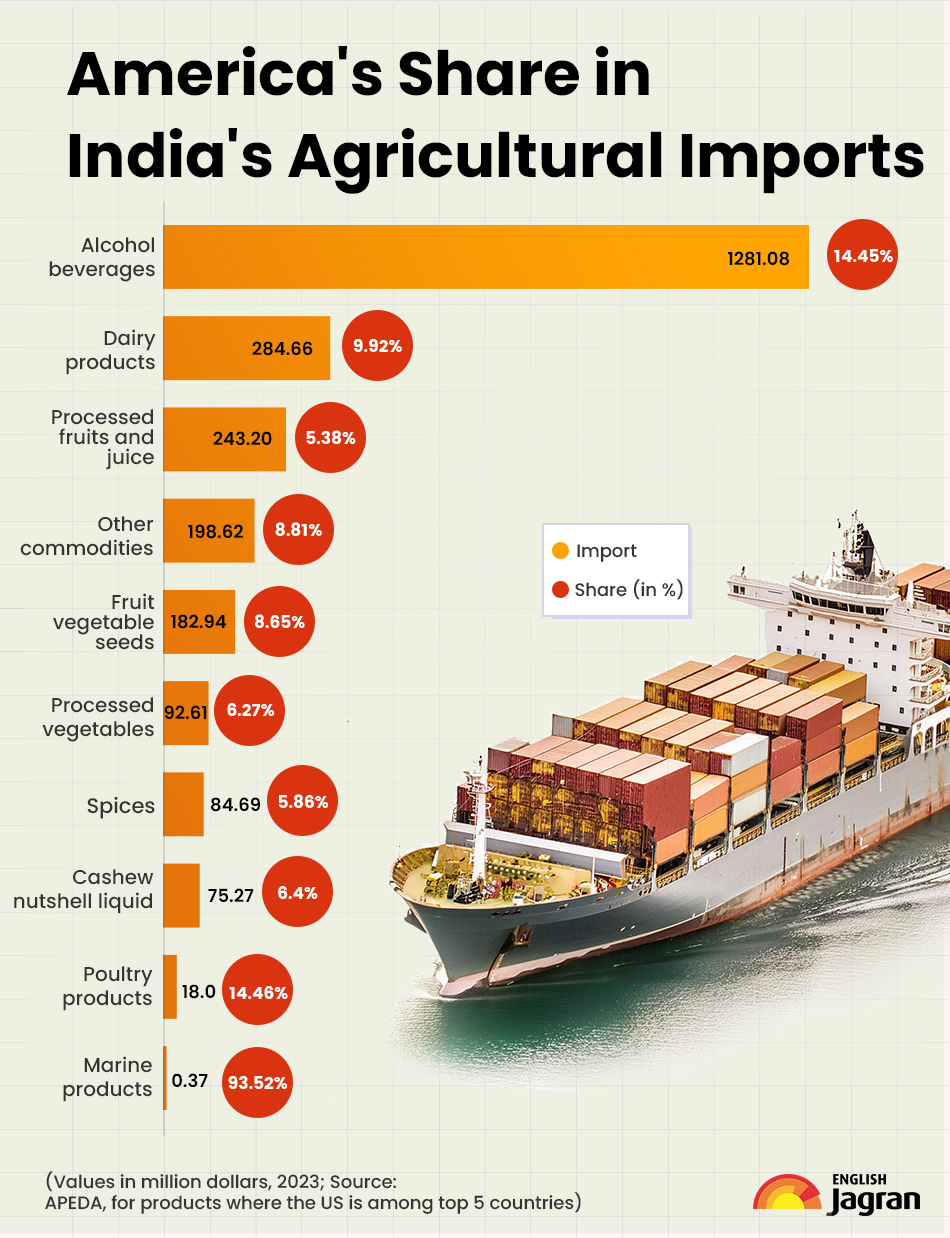

Last year, India imported 1.9 billion dollars worth of agricultural products from the U.S. This included almonds worth 865.6 million dollars, walnuts worth 24.5 million dollars, Brazil nuts worth 130 million dollars, pistachios worth 129.6 million dollars, ethyl alcohol worth 439.5 million dollars, apples worth 38.1 million dollars, and lentils worth 64.5 million dollars.

India’s Dependence On Agricultural Exports Is High

Crisil Intelligence Director Pushan Sharma explains that the United States is a major partner for India in agricultural commodities. In the calendar year 2024, India imported agricultural products worth a total of 38.3 billion dollars, with the U.S. accounting for 6 per cent of this. During the same period, the U.S. contributed 8 per cent to India’s agricultural exports. Last year, the United States imported a total of 222 billion dollars worth of agricultural products, with India’s share being 2 per cent.

In terms of agricultural products, the dependence between the United States and India is not mutual. The U.S. ranks fifth in India’s agricultural imports, while India exports the largest share of its agricultural products to the United States.

The potential increase in tariffs by the United States could negatively affect Indian exports. There are some products where the US holds a larger share of India’s exports, but India’s share in the total US imports of these products is not significant. In other words, the US imports these products in large quantities from other countries as well. These include shrimp and prawns, natural honey, and bakery products. If the US imposes reciprocal tariffs, the export of these products will be more severely impacted.

There are also some products where India holds a significant share in the US imports, but the US does not account for a large portion of India’s total exports of that product. In other words, India exports these products to several other countries as well. This includes products like milled rice and castor oil. The tariff risk for these products is lower because India’s exports do not heavily depend on the US market.

The Livelihood Issue for Small Farmers

Avanindra Nath Thakur, Professor of Economics at Jindal School of Government and Public Policy in Sonipat, says, “46 per cent of the workforce in India depends on agriculture, and among them, about 88 per cent are small and marginal farmers. For them, it’s more a question of livelihood than employment.”

According to Srivastava, “Reducing tariffs on agriculture without caution would be disastrous for India’s agricultural sector. Over 700 million Indians depend on agriculture for their livelihood. The increased import of cheap and subsidized commodities, especially sensitive ones like dairy, meat, grains, and pulses, would negatively impact the income of people in rural areas. The situation of villagers is already fragile, and it will worsen further.”

He says, “Farmers in the United States benefit greatly from subsidies and insurance, which often exceed their production costs. On the other hand, most farmers in India have small landholdings and limited resources. They rely heavily on government schemes like the Minimum Support Price (MSP) and the Public Distribution System (PDS). Reducing tariffs will not only affect these farmers but also weaken the food security of millions of poor families.”

According to Prof. Avanindra, “The United States and European countries already provide significant subsidies to agriculture. Their products are often sold at dumped prices. These countries can afford to do so because their GDP and employment dependency on agriculture is very low. It is not feasible for India to do the same, as half of our workforce is engaged in agriculture.” The population of the United States is 340 million, and only about 1 per cent of that population is involved in agriculture.

Prof. Avanindra says, “Small and marginal farmers hardly ever receive the market price. They do not have the capacity to store their produce, so they are forced to sell it immediately. Most farmers in India engage in distress selling after the harvest.”

On the impact of reducing import duties, Prof. Avanindra says, “In India, the demand for poultry is increasing, which uses corn and soybean as feed. In the future, the demand for both poultry, corn, and soybean will rise. Currently, corn cultivation is increasing in the country. If import duties on corn are reduced, it will affect those farmers who are shifting from traditional wheat and rice farming to corn cultivation. In recent years, India has become an importer of cotton rather than an exporter. Cotton demand is expected to grow rapidly in the coming years. If large-scale cotton imports from the US begin, it will have a very negative impact on Indian farmers.”

Image6- Tariff Differences in Agricultural Trade with the U.S.

Impact of Reciprocal Tariffs

The GTRI assessment suggests that reciprocal tariffs will have the greatest impact on fish, meat, and other processed seafood. Last year, India exported 2.58 billion dollars worth of these products to the USThe tariff difference stands at 27.83 per cent. India exports shrimp in large quantities to the US, but with such a tariff, it will no longer be competitive. The export of processed food, sugar, and cocoa exceeds 1 billion dollars, and these too face a tariff difference of 24.99 per cent. An increase in tariffs will make Indian snacks and confectionery products more expensive in the US.

Last year, exports of grains, fruits, vegetables, and spices amounted to 1.91 billion dollars, with a tariff difference of 5.72 per cent. Such a tariff increase could affect the export of rice and spices. In dairy products, the tariff difference stands at 38.23 per cent. If tariffs rise this much, the export of ghee, butter, and milk powder, worth 18.5 million dollars, could be impacted, and there is also a concern that the market share of Indian products could decrease.

In the last financial year, India exported 19.97 million dollars worth of edible oils, with a tariff difference of 10.67 per cent. Due to tariffs, Indian coconut and mustard oils will become more expensive in the U.S. The tariff difference on alcohol and spirits is 122 per cent, and on animal products, it exceeds 27 per cent. However, India’s exports of these products to the U.S. are not significant. Exports of tobacco and its products will not be affected, as the U.S. imposes higher tariffs on these compared to India.

FTA Negotiations With The European Union

Agriculture has been a major issue in the Free Trade Agreement (FTA) negotiations with the European Union (EU). The EU has been pressuring India to reduce tariffs on cheese and skimmed milk powder (SMP), while India has used high tariffs to protect its domestic dairy industry. In 2023-24, India exported 4.3 billion dollars worth of goods to the EU and imported 2.5 billion dollars. On average, Indian goods face a 15.2 per cent tariff in the EU, while India imposes an average tariff of 42.7 per cent on agricultural products coming from the EU.

According to Pushan Sharma from Crisil, India imported 1 billion dollars worth of agricultural products from the European Union in the calendar year 2024, while India’s exports were approximately 3.3 million dollars. If a Free Trade Agreement (FTA) is established, there is a likelihood that agricultural imports from the EU will increase.

He explained that the FTA would particularly impact the dairy industry and alcoholic beverage manufacturers. A reduction in import duties on alcoholic drinks would lead to increased imports from Europe, intensifying competition for domestic producers. As the world’s largest milk producer, India’s dairy industry would face challenges from the import of cheaper milk products from the EU, such as milk albumin, lactose, and whey. In contrast, the edible oil sector may face relatively less competition. India is heavily dependent on edible oil imports, and if sunflower and olive oil are imported from Europe, competition may rise in some segments but have only a minimal effect in others.

EU’s Non-Tariff Barriers Are a Challenge For India

The EU’s agricultural tariff system is quite complex and has often hindered negotiations between both sides. According to GTRI, the EU imposes non-ad valorem tariffs on 915 agricultural products, which significantly increases the import duties on these items. In addition, non-tariff barriers such as sanitary and phytosanitary regulations and Technical Barriers to Trade (TBT) make it difficult for Indian agricultural products to gain access to the European market. Even if the EU reduces tariffs, its regulatory framework will remain a major challenge for Indian farmers and exporters.

European wine producers are seeking greater access to Indian markets. Currently, European wines face a 150 per cent import duty in India. Europe wants India to either eliminate this duty entirely or reduce it to 30-40 per cent. Under the Economic Cooperation and Trade Agreement (ECTA) with Australia, India has agreed to gradually reduce wine import duties to 50 per cent over ten years. A similar arrangement may be possible with Europe. However, Indian wine producers are likely to oppose this, as cheaper imports would increase competition for them.

Agriculture in India is Governed by Protectionist Regulations

According to Srivastava, “India protects its agricultural sector in line with global trade rules. The World Trade Organization (WTO) allows developing countries to adopt measures to safeguard food security and rural livelihoods. India has consistently advocated for special treatment for agriculture in trade deals, and we should continue to do so.

He says, “The challenge is not just about tariffs but also about structural imbalance. Agriculture in the US and Europe receives substantial subsidies and is highly mechanized. In contrast, Indian agriculture is labor-intensive, and farmers struggle to earn a profit. Asking these farmers to compete with heavily subsidized American farmers is like asking a bicycle to race against a train.

Image8- Top 10 Agricultural Importing Countries in the World

What Should India Do?

According to Prof. Avanindra, “The demand for maize, soybean, and cotton is set to rise in India. Therefore, we should incentivize our farmers to increase the cultivation of these crops. Efforts must be made through research and development to improve their productivity so that Indian farmers can produce more. If imports are allowed freely, Indian farmers will never be motivated to respond to rising demand, and crop diversification will not take place.”

He says, “In trade negotiations, India should firmly present its position, citing food security and farmers’ livelihoods. Diversification of exports is also very important. We should move towards exporting processed food instead of raw crops. Processed food offers better prices, and its market is also larger.

According to Srivastava, “India’s priority should be to protect its food system, ensure farmers’ income security, and maintain rural stability, rather than accelerating trade liberalization that promotes inequality. Trade negotiations should be based on mutual respect and reality. India should remain open to dialogue, while also staying firm on issues related to farmers, food security, and future concerns.

However, Pushan Sharma argues that the impact of reciprocal tariffs from the US and the FTA with Europe will not be the same across all sectors. If the demand for prawns, shrimp, and honey decreases in the US, it can be compensated by increasing domestic demand and exporting to other countries. There will also be less impact on sugar (raw material for the alcoholic beverage industry), grains (raw material for bakery products), and dairy farmers because these products have various uses, and their supply is managed by multiple domestic and foreign manufacturers. Given the trade in agricultural commodities between India, the US, and the European Union, it is unlikely that these will be excluded from trade talks. India has a diverse range of agricultural commodities, including unique varieties like Alphonso mangoes and Basmati rice. These provide India with significant opportunities.

(This article is translated for Jagran English by Akansha Pandey)