Global powdered milk prices have dropped by 36 per cent in a year, but local consumers are not benefiting as leading companies have yet to adjust their prices.

Local manufacturers attribute this price discrepancy to the weakening Taka, reduced consumption amid mounting inflationary pressure and the ongoing dollar dearth.

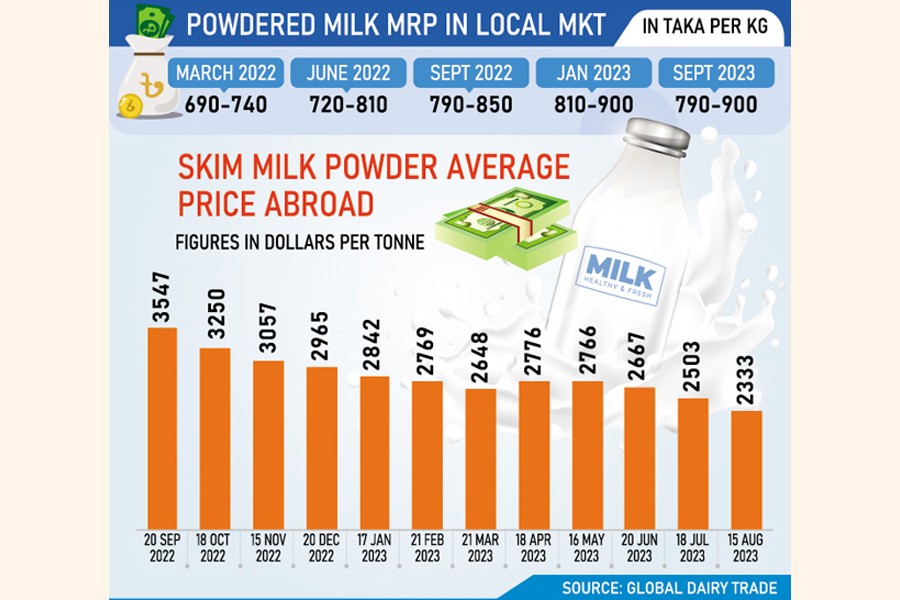

The average price of global powdered milk (Europe, Oceania, North America) has fallen to US $2210-2286 per tonne in September 2023, compared to $3520-3547 per tonne in the same period of 2022, according to GlobalDairyTrade – the global leading trading platform for core dairy products.

Interestingly, while global powdered milk prices were dropping, they were actually increased in Bangladesh.

Currently, the maximum retail price (MRP) of ‘Dano’ powdered milk – a product of multinational Arla Foods – is Tk 900 per kg. Diploma, a product of New Zealand Dairy, is Tk 850, Fresh of Meghna Group is Tk 840 and Marks of Abul Khair Group is Tk 820 per kg, according to grocers.

Most companies have raised their powdered milk prices by Tk 100-160 per kg in the last one and a half years, according to the Trading Corporation of Bangladesh (TCB).

Kamruzzaman Kamal, director of Marketing at Pran-RFL Group, said a decline in consumption, coupled with a significant devaluation of the local currency Taka against the US dollar, has posed challenges for businesses.

He said that while global powdered milk prices decreased by 35-36 per cent in a year, the Bangladeshi currency lost 18-20 per cent of its value against the dollar during the same period.

Besides, sourcing dollars for opening letters of credit (LCs) has also been difficult amid the crisis, he said.

In the last fiscal year of 2022-23, Bangladesh’s imports of milk and cream dropped to 118,000 tonnes, marking the lowest in eight years.

This slip occurred as a section of consumers reduced consumption of milk-based foods and beverages in an effort to manage costs amid heightened levels of inflation.

The last fiscal year’s imports of milk and cream were nearly 16 per cent lower than the volume imported the previous year, according to data from the Bangladesh Bureau of Statistics (BBS).

Saidul Azhar, head of Business (Danish) at Pertex Star Group, said, “Considering the inflation and devaluation of the local currency, the hike in powdered milk prices in the last year is rational.”

He added that sales have notably dropped due to low demand following higher inflation.

Humayun Kabir Bhuiyan, secretary of the Consumers Association of Bangladesh, pointed out that aside from powdered milk, prices of liquid pasteurised milk have also increased by 15 per cent in a year.

He urged the Trade and Tariff Commission and the commerce ministry to take immediate initiatives to review powdered milk prices, which could provide some relief to the common people.

[email protected]