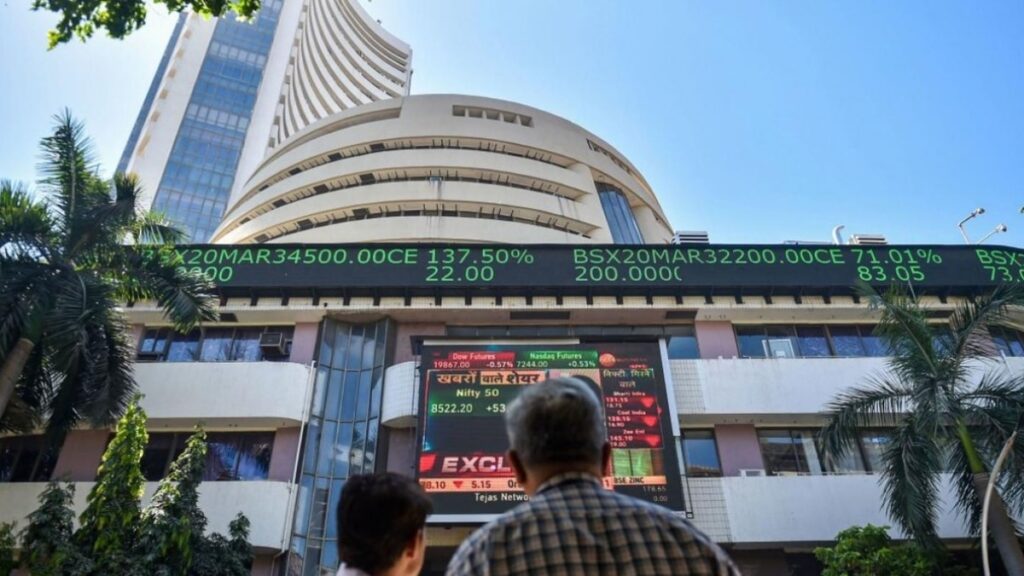

Bull run continued on Dalal Street and the domestic equity markets extended their gains on Thursday as the value unlocking on index heavyweights including Reliance Industries and ITC supported the buying sentiments. Amid the constant FIIs inflows, Nifty50 was barely shy of 20,000 market during the day.

For the day, the 30-share pack BSE Sensex gained 67,571.90 points, or 0.71 per cent, to settle at 67,571.90, while NSE’s Nifty50 added 146 points, or 0.74 per cent, to end the day at 19,979.15. BSE smallcap and midcap indices, somehow, managed to settle in green. Fear gauge India VIX rose about 2 per cent to 11.79-levels.

The market is witnessing frenzied buying support from foreign investors. Such has been the rally that some of the mild negative flows too are getting discounted in this bull run, said Shrikant Chouhan, Head of Research (Retail), Kotak Securities.

“Technically , after a muted opening the index took support near 19750 and reversed. On daily charts, it has formed a bullish candle and on intraday charts it is holding higher bottom formation, which is largely positive. However, the short-term texture of the market is overbought, hence we could see some profit booking at higher levels,” he said.

On a sectoral front, only the Nifty IT and consumer durable indices settled in red with the former dropping about a per cent. Among the gainers, Nifty healthcare, private bank, pharma, FMCG and financial services indices settled a per cent higher each for the session.

In the broader markets, ITC and Kotak Mahindra Bank rose 3 per cent each, leading the gainers in the pack. ICICI Bank, Dr Reddy’s Laboratories, Grasim, CIpla and Maruti Suzuki gained 2 per cent each. Tata Consumer Products, Reliance Industries, State Bank of India and Bharti Airtel were the other key gainers on the index.

Among the losers, Infosys dropped more than 2 per cent ahead of its Q1 earnings. Ultratech Cements shed more than a per cent for the day. Bajaj Finserv, Eicher Motors, Hero MotoCorp, HCL Technologies and Britannia Industries were the other key laggards.

Unlocking of value by heavyweights is apprising the main indices. The anticipation of a good Q1 results from Banks, is providing an extra boost to drive to new highs. Mixed cues from global peers is not disturbing the mood of the domestic market as FIIs inflows stay put to the prospects of the Indian economy, said Vinod Nair, Head of Research at Geojit Financial Services.

A total of 3,512 shares were traded on BSE on Thursday, of which 1,748 settled with gains. 1,632 stocks ended the session with gains while 132 shares remained unchanged. A total of 15 shares hit their upper circuit, whereas only four shares tested the lower circuit levels for the day.

Financials, FMCG & Healthcare fired up benchmark indices today which closed just shy of the magical 20k on the Nifty. FII’s have pulled off a 700-point rally in the Nifty since 3rd of this month at the start of the earnings season for the first quarter. Virtually all sectoral indices barring IT closed in the green today, said S Ranganathan, Head of Research at LKP securities.

In the broader markets, Dodla Dairy and Texmaco Infra hit upper circuits of 20 per cent each, while Jagran Prakashan surged 14 per cent. Indian Hume Pipes rose 13 per cent, while Newgen Software Technologies gained more than 12 per cent each. Polycab India gained 9 per cent, while Jupiter Wagons settled 8 per cent up.

Among the losers, Krsnaa Diagnostics plunged about 14 per cent each, while ABB India and Saregama India dropped 7 per cent each. HCL Infosystems declined 6 per cent, while Amara Raja Batteries, Patel Engineering and Sharda CropChem ended 5 per cent lower for the day.

Also read:┬ĀHot stocks on July 20, 2023: Infosys, Mazagon Dock, Reliance Industries, ITC and more

Also read:┬ĀStocks that share market analysts recommended on July 20, 2023: IndusInd Bank, Havells India, GAIL, LTIMindtree