Milk production

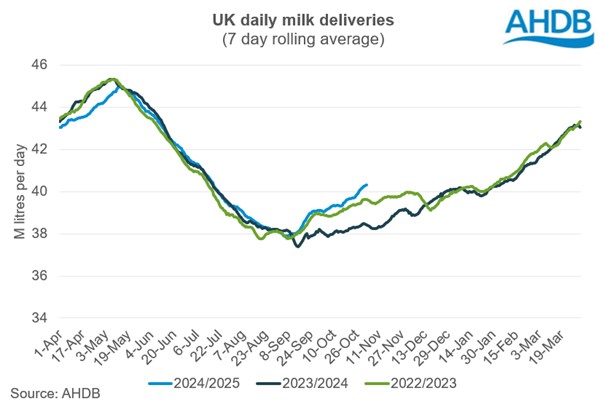

GB milk deliveries are estimated to have totalled 1,029 million litres in October 2024, a rise of 2.5% compared to the wet October 2023. Daily deliveries averaged 33.2 million litres per day.

Production for this year’s milk season so far (April-October) sits at 7,259 million litres. After a steady start to the year, a surge in Autumn production boosted overall output which is now only down marginally by 0.2% compared to the same period in 2023.

A combination of an attractive milk to feed price ratio, favourable weather and reports of increases in Autumn block calving has benefitted milk volumes, pushing production ahead of forecast.

Northern Irish milk production has been trending above 2023 levels for most of the year. Comprising 17% of total milk production, northern Irish milk production rose to a record high between April and August this year.

After the very wet September the ground has been drying well and with mild conditions many cows are still out which should take pressure off sileage stocks later in the season.

Expectations for milk production for the 2024/25 milk year will be revised in December to reflect changing market conditions.

Global milk deliveries averaged 782.0 million litres per day in August, a marginal decrease of 0.4 million litres per day (-0.1%) across the selected regions, compared to the same period last year. Australia, New Zealand and the US recorded year on year volume increases, whilst Argentina and the EU declined.

Milk deliveries in the EU averaged 376.6 million litres per day in August, a 3.6 million litre (-1.0%) reduction per day compared to the same month last year. The largest uplifts in production were seen in Poland, France and Austria, up by 37 million litres (3.5%), 14.1 million litres (0.8%) and 10.8 million litres (4.4%) respectively. Meanwhile, the steepest decline in milk volumes was seen in Italy, down 54.4 million litres (-5.4%), followed by the Netherlands which fell by 43.5 million litres (-3.9%) and Germany down by 33.3 million litres (-1.3%) with the impact of BTV making itself felt. Irish volumes were back by 20.3 million litres (-2.2%).

The EU’s short-term outlook was published earlier in the month and the European Commission expect milk deliveries in the region to increase by 0.5% in 2024 milk deliveries and are forecast to increase marginally 0.2% in 2025. Other key headlines are for Increasing yields to offset the declining dairy herd. Milk prices stabilised well above the 5-year average in 2024, easing margin pressures for farmers. However, exports are likely to remain subdued amidst weak global demand and price competitiveness challenges.

.jpg)

Wholesale markets

After last month’s record-breaking prices, the heat came out of the cream and butter markets to some extent. Demand has fallen off a little and with the milk taps switching back on buyers seem unwilling to commit to buy at such elevated prices. Many report feeling uncertainty in market direction which is holding big purchases back. However, supplies are still said to be tight and there are still short term needs to be covered. Cheese on the other hand remains more buoyant, with little difference of opinion on where the prices ought to be. The SMP powder market’s resurgence was short-lived and has seen some drift again this month. Important to note that average prices are reflective of the whole of the 4-week period.

Cream lost £51/t or 2%; butter lost £230/t or 3%; SMP lost £60/t or 3%. Mild cheddar, on the other hand, continues to march onwards and gained £150/t or 4%.

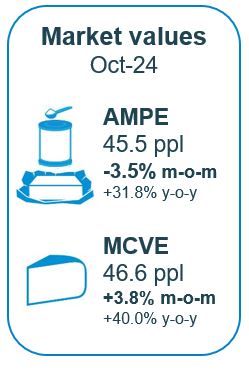

As of October, milk market values (which is a general estimate on market returns and the current market value of milk-based products on UK wholesale price movements) increased to 46.4ppl. AMPE decreased by 4%, MCVE gained 4% and is now ahead of AMPE. AMPE is now ahead of a year ago by 32%, with MCVE up by 40%.

The future direction of the market is not certain – although we saw some softening in October prices, continental butter prices and the GDT bounced upwards meaning markets may yet have more road left to run.

Farmgate milk prices

The latest published farmgate price was for September with a UK average of 43.1ppl, up by 1.5ppl, or 3.6%, on the previous month. Latest announced farmgate prices for November were positive for most (barring aligned which saw some declines in response to reducing costs of production), and continue the upward trajectory.

Price increases on aligned liquid contracts were mixed: small gains for Co-op and Waitrose contracts (+0.92ppl and +0.25ppl respectively), M&S and Sainsbury’s made no changes while Tesco announced a decline of 0.43ppl.

Non-aligned liquid contracts moved up between 0.5ppl and 1.20ppl in November. Paynes Dairies were at the lower end of the range (0.5ppl), having made a larger announcement last month. Freshways and Muller Direct both increased their prices by another 1.0ppl. Crediton also increased by 1.0ppl after a smaller increase last month, this being the sixth consecutive monthly price rise. Pembrokeshire Creamery, which only came online this spring, announced a 1.2ppl price rise for November, its fifth monthly increase.

Cheese contract saw stronger price increases than those of liquid milk, ranging between 1.0ppl and 1.55ppl. Leprino, Parkham Farms and Saputo announced rises of 1.0ppl with Wensleydale Creamery a little higher at 1.14ppl. Wyke farms announced the largest change on cheese contract this month, up 1.55ppl, closely followed by Barbers and Belton (both increasing their price by 1.50ppl). First Milk, Lactalis and South Caernarfon Creameries made positive changes of around 1.25ppl.

Manufacturing contracts recorded the largest price changes this month. Arla UK Farmers jumped a substantial 2.66ppl, while Arla Direct increased 1.71ppl. Pattemores upped their contract price by 1.25ppl, meanwhile Dale farm and Meadow made smaller changes at +0.98ppl and +0.5ppl respectively.

Input costs

In July, the API for all agricultural inputs fell to the lowest figure seen since December 2021, although it still remains elevated c 2020. Easing inflation can be seen across key inputs such as fertiliser, energy and feeds. With a much more stable picture in terms of farm input costs, this may begin to feed through into farmer confidence and planning.

Fertiliser price inflation continues to ease, back 9.2% on the same point of last year. In the past, we have observed changes in fertiliser application rates, as higher prices forced both farmers and the market to adapt. The more stable fertiliser price may have given confidence to allow farmers to plan their fertiliser strategy to maximise efficiencies in the first half of the year. However, rising natural gas prices in October raised concerns of an increase in fertiliser prices over the coming months. These have eased in November but are seeing some volatility.

Other key inputs have also seen decreases in inflation, with energy and fuel back 4.5% in July, compared the same month of the previous year. Straight feedstuffs were back 12.4% year on year, whilst compound feedstuffs recorded a 7.7% fall on the year. The Agonomics podcast recently discussed key input costs and the effects on UK farmers.

The milk to feed price ratio remains firmly in the expansion zone indicating that milk supplies should expect growth in the coming months.

UK retail demand

In the latest 52 weeks to 5th October according to Nielsen, volumes of cow’s dairy declined by 0.7% year-on-year. Growth in average prices (+0.6%) was not quite enough to balance volume losses as spend on cow’s dairy declined 0.1% according to Nielsen.

- Spend on cow’s milk continues to decrease (-6.6%) and volumes declined by 1.9% year-on-year (52 w/e 5 October 2024). Semi-skimmed cow’s milk accounts for 59.6% of volume sales but contributed most to the decline, while whole milk continued to see growth (+2.3%), driven by an increase in buyers as well as an increase in purchase frequency.

- Cow’s cheese remains in growth with volumes up 3.7% year-on-year, and spend to rising by 3.6% (NIQ Homescan POD, Total GB). Cheddar saw a 3.9% increase in volumes sold driven by an increase in volume per shop up 2.9%. This drove cow’s cheese performance as cheddar accounts for 41.7% of all cow cheese sold. Speciality and continental, processed cheese and British regionals also saw growth.

- Cow’s butter saw a volume decline of 3.5%, despite a decrease of average prices (-1.0%). However, block butter saw volumes increase by 5.7%. Plant-based spreads volumes increased, likely due to switching gains from cow’s butter as they were £2.10/kg cheaper.

- Volume sales of cow’s yoghurt, yoghurt drinks and fromage frais continue to grow, now up 6.1% and spend increased by 8.4%. Despite increasing prices, most of the cow’s yoghurt categories saw volume growth. Standard plain yoghurts grew the fastest, up 21.7% (NIQ Homescan POD, Total GB).

- Cow’s cream volumes grew by 2.1% year-on-year, primarily driven by existing shoppers buying more. Double, sour cream and crème fraiche all experienced volume growth.

- See the full data and these insights visualised on our GB household dairy purchases retail dashboard.

.JPG)

.JPG)