The Australian dairy industry is heading for more consolidation as milk supply shrinks, according to dairy analyst Steve Spencer.

He told Dairy News that as that consolidation occurs, assets and processing capacity will go with it.

He was commenting on the decision by major Australian milk processor Saputo to close its King Island Dairy plant and retire the iconic brand by mid-2025, impacting 58 employees. King Island Dairy, which began in the 1900s, is renowned for its specialty cheeses. Canadian dairy giant Saputo bought the business in 2019.

Melbourne-based Spencer is managing director, global insights for Ever.Ag Insights, a global market intelligence and advisory provider for the ag sector.

He says, like other parts of Australia, milk supply on King Island, part of Tasmania, is also dwindling.

“There is dwindling milk production on the island, to keep provenance with that name, and it is an expensive place to get milk and product to and from. It is not attractive for someone to take on, even those in the speciality category,” he adds.

Saputo says that over the past 10 months, it has sought to maximise value for the business by conducting an intensive review of all commercial and financial alternatives for King Island Dairy, including a potential sale to a third party.

The company says its immediate focus will be to work with its valued King Island employees, dairy farmers and the broader King Island community to support them through the transition period.

Leanne Cutts, president and chief operating officer (International and Europe) Saputo Inc, says the decision had not been taken lightly.

“After thoroughly reviewing every possible option, closure of the facility was determined as the most viable way to strengthen SDA’s competitiveness based on changing industry and market conditions.

“As King Island Dairy’s historic roots are deeply embedded in the region, it was hoped the strategic review would identify a potential buyer for the facility. It is a unique brand, with a plant that is nearly 100 years old and designed to produce hand-made specialty cheeses.”

The news has shocked the 1600 residents of the island but they are still hoping for someone to buy the business. King Island Dairy is one of the biggest employers on the island.

King Island Mayor Marcus Blackie told ABC News that said the news was “sad and concerning”, and his heart went out to the company’s 58 employees.

“However, the second-last chapter of the book isn’t the end; there is the potential for someone out there who has admired King Island Dairy from afar to possibly come in and rescue the brand yet,” he said.

Blackie said domestic and international cheesemakers had long admired the King Island Dairy brand, and hoped they’d snap up the business.

“Now is their chance to swoop in and rescue a legendary brand that doesn’t deserve to be retired, so I encourage them to move now quickly before it’s too late.”

Milk production in Australia in the 2023/24 season, which ended in June, was 3.1% higher on the previous year at 8.4 billion litres which was an increase of 249 million litres. However, this season, milk production is forecast to grow at 1.5%.

Australia produced 8.129 billion litres of milk in 2022/23, marking not only the third consecutive year of decline in milk production but also Australia’s lowest available supply of milk for manufacturig – products including cheese and milk powder – since the 1990s.

Since the most recent production high in 2020/21, more than 700 million litres have been lost from the supply chain, resulting in a chronic shortage of milk for manufacturing, according to Rabobank.

Spencer says there’s intense competition in retail between brands and private label milk and dairy products.

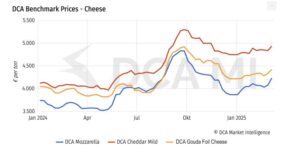

However, he notes that the competition at farmgate is not as intense this year, as production conditions have been okay, and companies were cautious about over-paying for milk – as happened in the 2023-24 season with the slippage in commodity prices last spring.

“If the rising global market prices flow into this market, which will be delayed for various reasons, and production slows after spring, then there may be greatest contest for milk post-peak.

“But most milk is locked into contracts and limited volumes can freely move between processors. The greatest issue is whether we’ll see greater pressure on farm exits as the season rolls on.”