According to the bank the EU dairy industry saw “considerable growth” over the past decade following the end of the milk quota system in 2015 which in turn led to a surge in investment in processing capacity.

Rabobank stated: “For over a decade northwestern Europe (Denmark, Germany, the Netherlands and Belgium) has been at the center of EU milk supply growth, accounting for about 39% of volume growth since 2010.

“If we include production growth in Ireland and Poland this percentage surpasses 70% demonstrating the EU’s dependence on a concentrated pool of milk volumes in northwestern Europe.”

But the bank’s analysis shows that since 2020 milk production has come to a “standstill” and there has been an “accelerated decline” in northwestern Europe’s dairy herd – which has reduced by an estimated 1.4% each year.

It has attributed the “structural downturn” in milk production to weakened margins, environmental regulations, labour shortages, and climate related challenges.

The bank has also warned that the decline in milk volumes could be stronger than previously anticipated in part because of the looming 2027 deadline for EU water quality regulations.

It highlighted in the report published today that these deadlines had already resulted in restrictions on nitrogen derogation in Flanders, the Netherlands, Ireland and Denmark.

“Ultimately water quality and biodiversity regulations point towards an accelerated decline in the dairy herd – due to a reduced carrying capacity per hectare and further restrictions on the usage and application of chemical fertilisers,” the bank stated.

Rabobank

According to Rabobank it believes there are two potential scenarios now facing the industry in the EU.

The first is a 13% decrease in milk production that would knock out nearly all the production growth since 2010.

The second which it describes as a “more drastic downside scenario” is a 20% reduction in production.

“This downside scenario poses a risk of significant revenue losses and capital constraints, with cooperatives likely to be the hardest hit,” Rabobank warns.

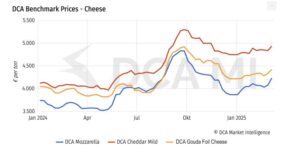

Richard Scheper, the bank’s dairy analyst, believes these challenges will force dairy companies to shift their focus to high-value products such as specialty proteins, branded consumer goods, and cheese.

“This move would counterbalance rising costs and preserve market competitiveness as milk processing capacities exceed supply.

“As the industry braces for change, dairy producers must prepare for potential financial challenges and consider consolidation as a means to adapt to the evolving market landscape,” Scheper warned.

Rabobank has forecast that the most significant percentage drop in milk production will be in the Netherlands – potentially 20%, then Flanders, and Denmark.

But it expects that the greatest volume decline will be in Germany.