The recovery in global milk prices evident in late 2023 and continuing into early 2024 has “cooled slightly” in quarter two, according to new research published today (Tuesday, May 7) by Rabobank.

Rabobank had expected to see “slow but steadier” price increases for 2024.

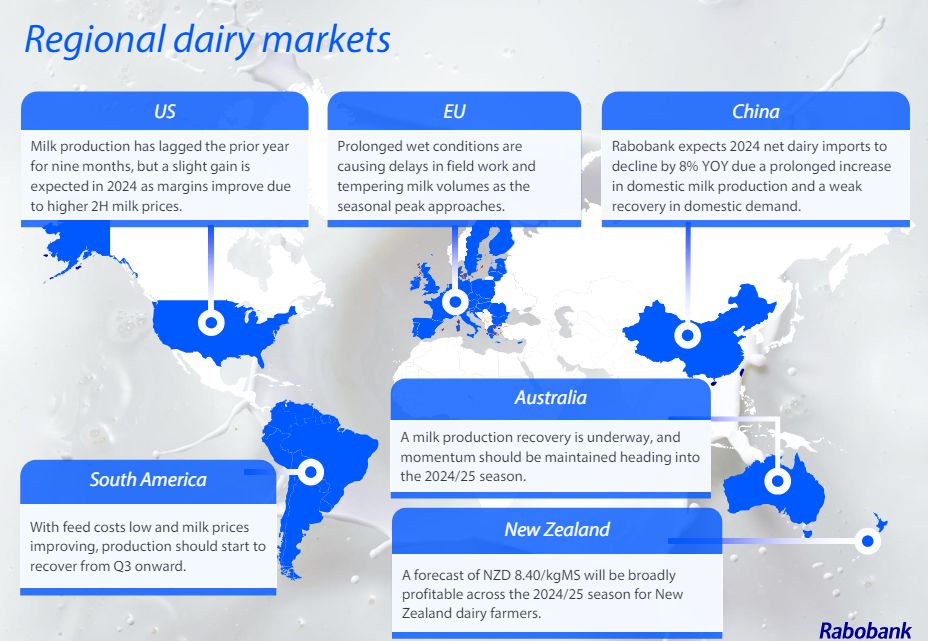

However it warned today that “excess rains” in Europe and other weather related issues had heavily impacted on milk output and it also pointed to weaker global demand and higher domestic milk production “limiting Chinese imports”.

The bank’s analysis indicates that buyers are “turning more cautious”.

“Dairy buyers took advantage of low prices in late 2023 and early 2024 to replenish stocks.

“However in anticipation of a seasonal peak in northern hemisphere milk production sentiment is shifting in most regions, with purchasing slower at current price levels,” Rabobank stated.

Milk prices

The latest global dairy quarterly report also highlights that demand recovery signals “are mixed” while customers’ purchasing power remains under pressure chiefly because of high inflation in most countries.

Meanwhile specifically in Europe Rabobank identified that the late arrival of spring combined with the “surplus rainfall” has delayed “the seasonal flush”.

“Extremely wet conditions continued into April and delayed the pastures season, especially in Ireland due to the reduced carrying capacity of pastures.

“In other parts of the region conditions have resulted in poor winter crop development delayed field work.

“Mild temperatures stimulated a better start of grass growth last year. As such the impact on milk volumes varies across the continent,” Rabobank warned.

Its analysis also shows that EU and UK milk deliveries for January and February declined by nearly 0.5% year on year – including leap year calculations.

“Irish milk volumes dropped by 16.3% or 98,000mt, during this period while Dutch milk deliveries decreased by 2.7% or 63,000mt.

“Germany and the UK posted lower volume declines of 0.6% and 0.9%.

“On the positive side France recorded the first year on year growth – 0.1% of 3,000my since December 2022,” the bank detailed.

It also noted that milk production in Spain increased by 1.6% and Poland saw the “strongest gains” with deliveries up 3.1% year on year.

But overall Rabobank believes that when it comes to market prices the current recovery “will be slower” than it had previously anticipated.

“The jump in prices in late 2023 and early 2024 appears to have been more a response to low prices and restocking than a sustained improvement in consumer demand in most regions.

“China’s reduced dependency on imports will also be a headwind for the global dairy market in the coming months, ” the bank cautioned.