According to a new report from international financial services company Rabobank, limited milk supply growth and lackluster demand led to soft dairy commodity pricing in 2023. However, the global dairy market appears to be transitioning to the next phase in its cycle, with prices projected to move higher through 2024. Still, the market remains finely balanced, and uncertainty remains surrounding underlying demand for 2024.

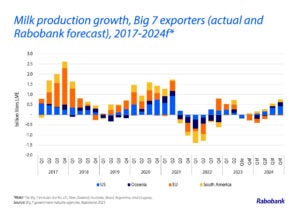

As 2023 draws to a close, the global dairy market continues to walk a tightrope of limited “new” milk and sluggish demand. The year saw soft global dairy commodity pricing due to weaker underlying fundamentals. Global milk supply growth was underwhelming, with three consecutive quarters of growth. Then lower milk prices, elevated costs, and weather disruption put the brakes back on.

The report, titled Shifting to the Next Phase of the Cycle, says that in the United States, “Tightening margins drove increased culling and subsequent milk production pullback. Slaughter has slowed and profitability is improving, but not yet signaling expansion.”

Other key areas, including the European Union and South America, are seeing difficult margins amid declines with some pockets of optimism.

Rabobank’s milk supply outlook for 2024 has weakened, with sluggish growth expected across most export regions.

“The milk supply export engine never fully fired on all cylinders in 2023 and declined year-on-year in the third quarter by 0.2 percent,” said Michael Harvey, a senior dairy analyst at Rabobank. “Year-over-year milk production from the Big 7 exporting regions is forecast to decrease through Q1 2024 before turning positive. Overall, milk supply is forecast to grow by a modest 0.3 percent for the entire year.”

Other factors to watch in 2024 include a mildly softer grain and oilseed price outlook, El Niño and weather-related risks, mixed livestock markets in export regions, and the impact of the Israel-Hamas war on global markets.

A slow recovery in prices

In local currencies, farmgate milk prices across the export regions will close out 2023 anywhere between 20 percent to 40 percent lower versus the start of the year. However, with the 2024 feed cost outlook looking more favorable, some regional milk prices have recently increased, boosting farmgate margins.

“We expect a slow recovery in dairy commodity prices back to long-term averages,” Harvey said. “However, current fundamentals provide the perfect ingredients for price volatility and a possible market whiplash. Geopolitical instability risks, volatile energy markets, and weak macroeconomic conditions will be something to watch in 2024 for the global dairy markets.”

Demand uncertainty ahead

Demand will be a key factor to watch in 2024, with high dairy inflation, broader cost-of-living issues, and weak consumer confidence remaining on the horizon. Peak food and dairy inflation have passed, but market uncertainty remains, and rising unemployment will further impact purchasing power in 2024. Emerging markets and low-income households are under the most pressure.

In China, consumer prices are falling and foodservice recovery continues, but overall consumption growth is sluggish. China’s import appetite for dairy commodities is still expected to drive any Oceania commodity price rally in 2024. “Rabobank expects China’s import volume to flatline in 2024, which would be a positive result, given the previous two years of withdrawal from the global markets,” explains Harvey. “This is an opportunity for importers outside of China to build stocks in 2024.”